Cloud adoption is becoming almost an inevitability for insurers of all stripes. The advantages of cloud-based core systems over increasingly antiquated on-premises systems — ranging from expedited deployments to more expansive platform capabilities — are well-established and widely accepted at this point. Gartner predicts that more than half of all enterprise IT spending in multiple key market segments will be devoted to cloud solutions by 2025.

However, while the accelerating rate of cloud adoption is easily observable, the specific factors driving this acceleration — and more importantly, defining cloud success — can be more opaque.

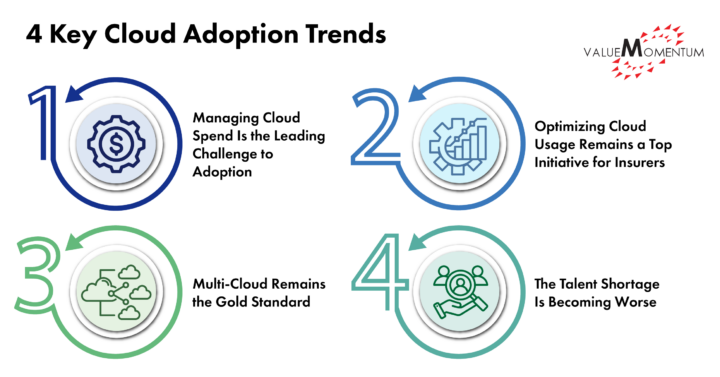

In this post, we’ll consider the top 4 cloud adoption trends that insurers need to be mindful of when developing their own cloud strategies so they can take full advantage of the incredible opportunities the cloud revolution offers them.

1. Managing Cloud Spend Is the Leading Challenge to Adoption

While the COVID-19 pandemic laid bare several of the profound strategic advantages cloud-based core systems have over on-premises ones, the economic headwinds that followed shortly afterward in 2023 have made many insurance executives hesitant to fully embrace cloud adoption.

The simple truth is that however invaluable the cost-savings a cloud-based core ultimately brings, the initial costs of cloud adoption can be significant. Moreover, a host of sustained investments are usually necessary to maintain cloud solutions, which can further deter investment in these uncertain economic times.

To balance the necessity of cloud adoption with the reality of shrinking budgets, many insurers are relying on a hybrid solution of utilizing a combination of cloud-based and on-premises services in the interim for core business systems. This approach has its own challenges, however economical it may be, but application management services are a proven solution for solving many of them.

2. Optimizing Cloud Usage Remains a Top Initiative for Insurers

Unsurprisingly, improving cloud efficiency — as with any technology still in its relative infancy — persists as a challenge for most insurers. Even after the migration process is complete and insurers have evolved beyond hybrid models, many insurers still haven’t mined most of the efficiencies that a cloud-based system has to offer. While every organization has slightly different optimization challenges and opportunities, general best practices remain.

Minimizing data movement in the case of hybrid environments will translate to significant time and resource savings, with mission-critical data ideally being stored in on-premises servers and applications being held by cloud data centers. Autoscaling is also underutilized, despite the fact that cloud platforms are capable of automatically scaling user resources on demand to adjust to dynamically changing needs. Cloud performance optimization should also be measured against cloud cost management, as optimizing cloud performance almost always requires additional cloud spend.

3. Multi-Cloud Remains the Gold Standard

Most insurers still operate according to a hybrid, multi-cloud model, and many large enterprises even employ multi-cloud cost optimization tools, indicating the multi-cloud approach will likely remain popular for a while. Generally, no single cloud platform can meet the unique and dynamic needs of every insurer, so the agility of a personalized, multi-cloud strategy — combining the better storage, easier implementation, and greater innovation of several cloud platforms — continues to be a strategic advantage.

However, multi-cloud has its own complexities and challenges, ranging from talent shortages to accommodating legacy architectures, so insurers are advised to consider insurance business use cases, carefully select the right models and providers for their specific needs, and determine whether a public, private, or hybrid cloud solution is right for them.

4. The Talent Shortage Is Becoming Worse

As more insurers embrace cloud adoption, and with fewer cloud professionals to manage the transition, the already fierce talent war is becoming more fierce. According to an IDC survey, 70% of IT leaders consider the global cloud skills gap to be an urgent problem, with 34% reporting that lack of cloud talent has already negatively impacted their plans to launch new products and services.

Although factors like the “Great Resignation,” diminishing interest in insurance careers, and a wave of retirements in the insurance sector are largely beyond the power of individual insurers to control, they still have proven talent attraction and retention strategies available to them.

Investing in professional development initiatives to encourage long-term organizational loyalty, along with flexible and/or hybrid working arrangements, will be instrumental in enabling insurers to win this fight. Insurers should also prioritize retention over acquisition whenever they are forced to choose, as cloud demands are increasing at a far faster pace than most markets are training new cloud specialists.

Succeeding in a Cloud-Based World

Pursuing the increasingly invaluable strategic advantages of flexibility and scalability, insurers will continue to prioritize cloud adoption. Insurers who remain wedded to legacy platforms will lose market share and the mission-critical ability to innovate to those who embrace a cloud-based future.

Whether you operate in the popular hybrid model space, have already migrated fully to the cloud, or are just beginning, ValueMomentum can help. We have more than 20 years of hard-won, proven experience in driving successful cloud initiatives for organizations like yours.

Discover our full suite of cloud and infrastructure services, engineered to enable you to chart your own course to cloud success.