Cloud adoption is no longer a far-flung ideal for insurers today. According to a 2022 insurance survey from Aite-Novarica, 92% of insurers have engaged in some pilot plan or transition to cloud. This proves one big point: there is widespread acceptance of the advantages that cloud enables. These advantages include faster deployment, scalability, and expanded platform capabilities. Indeed, cloud is also becoming a key necessity for insurers who wish to apply advanced technologies across artificial intelligence and new data infrastructures.

What is Multi-Cloud?

But for many insurers, a single cloud system may not be enough. Most enterprises utilize multiple cloud solutions—thus, the term “multi-cloud,” or the combination of two or more cloud solutions, whether it’s software (SaaS), platform (PaaS) or infrastructure (IaaS) in the cloud. Insurers utilize multiple cloud solutions for different capabilities, such as expanding storage for new markets or adding advanced automation tools. With multi-cloud comes higher business agility; it allows insurers to pick and match services based on specific business objectives, further secure data usage and storage, and scale business operations with flexible interoperability.

Challenges remain, however. While multi-cloud certainly brings its benefits, the journey to implementation carries its own obstacles and complexities—both technical and cultural. Insurers are often lost in what specific strategy can marry existing legacy structures and Cloud, while also struggling to decide what kind of cloud solutions they should utilize. This blog attempts to illuminate some of the challenges that plague insurers with Cloud adoption and outline key considerations for insurers to design their own multi-cloud strategy.

Multi-Cloud Challenges

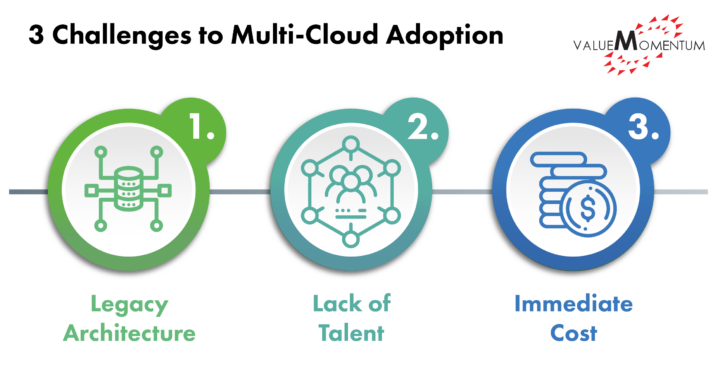

As a technical and cultural transformation, cloud adoption is not without major revamps of existing IT structures and shifts in mindset. While agility and speed serve as strong drivers motivating insurers to adopt cloud, the following challenges impede the journey:

1. Legacy Architecture.

With manual processes and on-premise data structures that do not allow customization, legacy architectures will soon become much more difficult to staff and manage for insurers. But not all legacy architectures may make sense to replace. Based on the particular needs and timelines of each insurer, some insurers can take hybrid approaches to outsource legacy structures while investing in new Cloud initiatives.

Either way, achieving full cloud deployment value will require one to assess exactly which business and technical processes—from data storage to customer experience—can benefit most from migrating to cloud. 100% cloud is not always the answer, although a long-term plan to transition will be necessary.

2. Lack of Talent.

This goes hand-in-hand with the need for a cultural shift—most employees are not equipped yet nor willing to make the shift to deal with a cloud infrastructure. Aite-Novarica states that 40% of insurers note the lack of skill and talent as a disadvantage to Cloud. Investment in cloud architects will become critical to manage both the transition to and maintenance of cloud infrastructure. Based on an insurer’s familiarity and readiness to embrace cloud, a technology provider may need to step in to perform the technical legwork.

3. Cost.

Cloud does not come cheap. Due to the additional costs to migrate and maintain the infrastructure, a short-term plan with cloud may come with more caveats than benefits for some insurers. However, cloud’s new capabilities and functionalities can accelerate speed-to-market for new releases and expand scalability enterprise-wide to balance out those costs in the long run.

Tackling these challenges require insurers to set out a clear blueprint and initial cloud strategy. Insurers must be hyperaware from the get-go exactly which capabilities they need to utilize, and which platform combinations will serve to offset costs and reduce technology debt.

Key Considerations to Identify and Maximize Multi-Cloud Capabilities

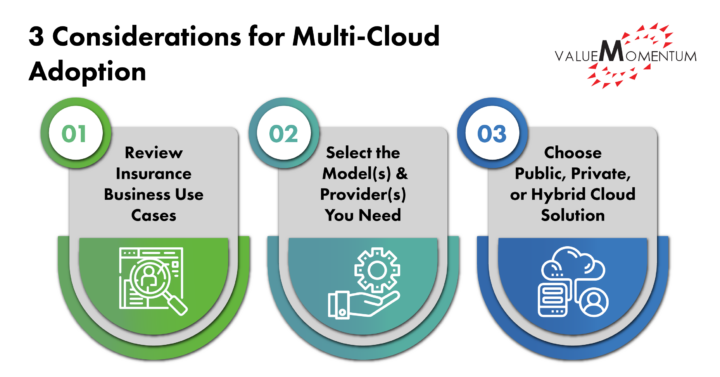

At its essence, a cloud platform provides a server to host and create applications without the need to manage the infrastructure. What the multi-aspect of cloud strategy addresses is the issue of compatibility—no single platform can resolve all the needs of an insurer. One platform may provide innovation capabilities. Another gives good host storage. And some are ready-made, faster and easier to install. Thus, a personalized, multi-cloud strategy that takes what’s useful in each solution will be essential to achieve agility and productivity. The following considerations can guide an insurer to their multi-cloud journey:

1. Insurance Business Use Cases for Multi-Cloud

Insurers must outline firsthand which capabilities within their own existing systems need updates and revisions and identify business use cases for cloud. What can multi-cloud offer to improve their insurance capabilities and future expansion? The answer to this may boil down to the following:

- core insurance platform hosting

- Cloud API integration

- Infrastructure automation

- scalable data storage and integration

An example use case could involve securing customer information across new regions via cloud data storage outside an insurer’s usual geographic bounds. Another could implement a cloud-based core system with an API platform that further streamlines communication across customer, agent, and provider and accelerates claims processing. Knowing which insurance use cases are needed will directly answer the next step.

2. Choose the Model(s) and Provider(s) You Need for a Multi-Cloud Platform.

Software as Service (SaaS) has often been the primary go-to-cloud subscription model for many enterprises, offering a built-in cloud storage and infrastructure over the internet without manual installation. Addition to that is Infrastructure as a Service (IaaS), which provides a cost-efficient, pay by use infrastructure that relieves the burden to maintain insurers’ own physical hardware. Platform as a Service (PaaS), on the other hand, provides runtime environments for insurers to deploy their own frameworks on cloud, allowing customization across API, microservices, UI, and integration for customer-facing applications.

Cost, use case, and technology all factor into insurers’ choice of solution and provider. Azure Cloud’s Cognitive Services, for example, offer a serverless computing solution with built-in APIs that smoothly merge on-premise and cloud applications. Another example, Boomi, provides a cloud-native integration platform that modernizes legacy infrastructure for insurers along with robust integration and workflow automation.

3. Decide on a Public, Private, or Hybrid Cloud Solution.

Along with models, insurers must decide on a private, public, or hybrid cloud solution. Private cloud usually replicates on-premise data centers, utilized by predefined users. Public cloud meanwhile employs cloud providers over the internet, relaying responsibility to the provider itself for infrastructure maintenance. In recent times, more insurers are moving to a hybrid solution, dominantly utilizing hyper scalar platforms such as Amazon Web Services (AWS) or Google Cloud.

Managing emerging solutions, multiple operating models, as well as an expanding data storage can become difficult to maintain on-premise. Simultaneously, a solely public cloud poses security risks, especially for insurers dealing with sensitive customer information. Depending on the insurer’s goals and point of journey, a hybrid multi-cloud solution could add enhanced cybersecurity features while relieving key complexities and burdens—such as the need to train technical skills to staff, maintain existing legacy architectures, and streamline data management and governance from on-premises to cloud.

A Multi-Cloud Strategy to Power Your Business

Cloud is not solely for employees—it must involve all participants from a 360 degree perspective, including customers, third-party users, agents, and other stakeholders. Insurers deciding on a multi-cloud strategy must situate it against a larger ecosystem of third-party solutions and partnerships. Cloud adoption must accommodate those relationships emerging across customers, employees, and stakeholders across this ecosystem to fully realize its agility and productivity.

Multi-cloud strategy is a critical necessity for insurers who seek agility and speed to market through cloud, but don’t know where to begin. While the initial costs and investments may seem onerous, a clear blueprint showing the exact platforms and capabilities an insurer wants as well as a technology implementation partner can successfully guide insurers in their journey to multi-cloud adoption.

See how ValueMomentum can help accelerate your cloud adoption. Check out our Cloud & Infrastructure Services.