Enterprise cloud adoption has accelerated over the last several years, and insurers are showing no signs of slowing their preference for cloud-based deployments. A 2022 report from Datos Insights indicates that cloud adoption grew from more than 70% of insurance carriers in 2018 to greater than 90% last year. However, organizations making the switch have realized that managing their cloud spend is no easy feat.

Without a transparent view into how the costs of an insurer’s cloud footprint are adding up, it is easy for spending to balloon out of control. To manage their cloud spend, insurers have started to build out financial operations practices — FinOps — that can provide them with the insights and governance they need to optimize their cloud investments.

What Is FinOps?

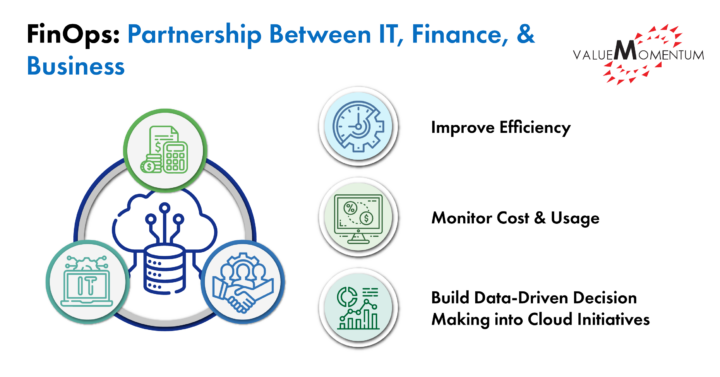

Just as DevOps refers to the practice of collaborating across development and operations teams, FinOps involves a strong partnership between IT, finance, and business teams to manage cloud usage while maintaining financial accountability. FinOps has multiple goals: improving efficiency, monitoring costs and usage, and building data-driven decision making into cloud initiatives.

In addition, FinOps practices can help organizations use reporting and established metrics to uncover cost drivers in their cloud programs, note opportunities to optimize their spending by identifying overprovisioning or unused resources, establish approval processes and controls for additional cloud spend, more accurately forecast future spending, and generally maximize the value of cloud investments, including architecture and purchase decisions. Ultimately, FinOps helps organizations ensure that their cloud investments align with their business priorities and can demonstrate clear return on investment (ROI).

Introducing this cultural mind shift won’t be easy, but the payoff is clearly worth the effort. As insurers continue to build out their cloud infrastructure, FinOps can help provide the control framework needed to govern cloud migrations and implementations while helping insurance IT leaders demonstrate the business value of these efforts.

FinOps in Action: Insights From ValueMomentum Engagements

FinOps practices are relatively new. The FinOps Foundation reports that 67.8% of organizations implementing these techniques are still in the “Crawl” stage. However, ValueMomentum has already begun working with several insurance clients to help them benefit from FinOps practices as part of their cloud migration.

These include:

- Assessing a large, global property and casualty insurer’s $5M annual Amazon Web Services (AWS) spend, identifying unused resources, outdated architectures, and opportunities to right size licenses. Our recommendations included consolidating databases, scaling down overprovisioned assets, instituting approval controls, and reserving instances. By implementing these steps, we found that the client could save 30% on the cost of its cloud base.

- Implementing FinOps disciplines for a top-20 national property and casualty insurer to instill financial governance into its cloud strategy. The insurer spends roughly $10M each year on cloud services but lacks full visibility into the results of these investments. Our team started by gathering data on cloud usage and expenditures. After creating a baseline of current consumption, the next phase will include decommissioning unused assets; evaluating the enterprise architecture; and improving processes for cloud budgeting, procurement, and brokering.

- Initiating a project with a top commercial lines insurer whose volume of cloud assets has led to significant monthly costs. ValueMomentum is working with the carrier to build out a FinOps model for its AWS-based infrastructure, beginning with assessing pain points and identifying opportunities to cut costs. The company’s goal is to improve overall cost management and accountability as it continues to expand its cloud footprint.

Preparing for FinOps Success: 3 Steps to Jumpstart Your Journey

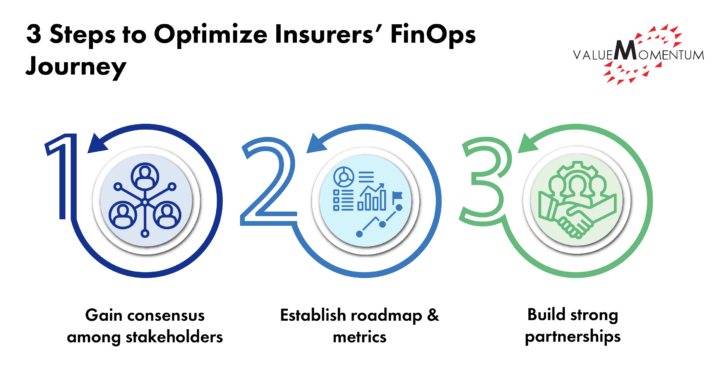

As insurers adopt a growing number of cloud-based systems and solutions, implementing FinOps practices is a vital step on the path to success. However, building a new discipline into an organization from the ground up is no easy task. Here are some steps to help insurers optimize their FinOps journey.

1. Gain consensus among stakeholders.

At its heart, FinOps is a discipline rooted in collaboration. The first step toward making a successful FinOps program is building consensus and gaining buy-in from all relevant stakeholders across the IT, finance, and business teams who will be most directly impacted by this shift in mindset.

It’s not uncommon for an organization to establish a Cloud Center of Excellence (CCoE) or a central team responsible for standardizing processes and leading overall adoption efforts. These stakeholders will then determine the goals of the practice, which teams are accountable for what tasks and reports, and what pain points your organization can anticipate along the way.

2. Establish a roadmap and metrics.

Once everyone is aligned on the importance of FinOps and how the relevant teams will collaborate to bring the practice to life, it’s time to make a plan. Once you’ve measured your baseline cloud costs and current state — and made that data available to the appropriate stakeholders — identify what your goals are for your cloud future state.

Answer questions like:

- What tools does your organization have that can be useful?

- What additional tools might you need?

- How will your team measure the success of the program?

- What key performance indicators (KPIs) will be most useful as you start your journey?These are just the first questions you will need to answer. Each team’s perspective will be invaluable in this collaborative process and may lead to questions the other departments may not have considered.

3. Build strong partnerships.

Not every organization is equipped to build a FinOps program from the ground up. If that’s the case, build a strong partnership with an outside organization that has deep experience with both the insurance industry and cloud systems.

An outside party can work with you to develop a cloud strategy tailored for your specific needs, from analyzing your infrastructure to identifying gaps in current cloud tool usage to determining which costs can be eliminated.

IT services partners can also handle cloud setup and management for your organization while aligning with your finance team and budget constraints. An additional benefit of partnering with an IT services firm is that while your organization may not have launched a FinOps practice before, it’s likely that the IT services firm has and can serve as a trusted advisor for future success as well as initial setup.

With cloud adoption continuing to grow and become a bigger proportion of IT spend, insurers can’t afford to waste a cent of their cloud budget. One of the best ways to ensure cloud investments are being allocated efficiently and optimally is by implementing FinOps.

Whether you’re midway through your FinOps journey or just starting out, ValueMomentum has decades of experience helping organizations like yours with technology and cloud initiatives, including multiple FinOps projects. Learn more about our cloud and infrastructure services here.