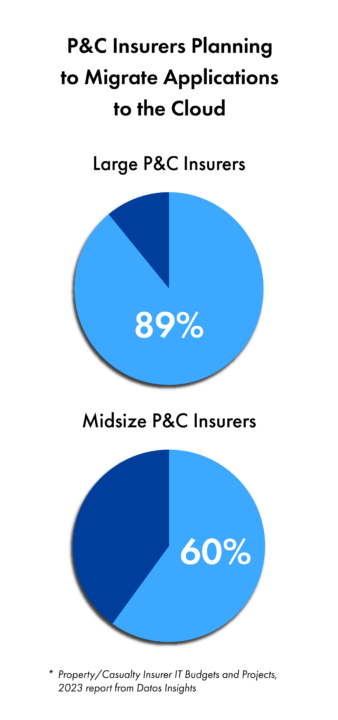

Insurers have been steadily increasing their cloud spend over the last few years, and there is no indication that this trend will slow down. In its report “Property/Casualty Insurer IT Budgets and Projects, 2023,” Datos Insights reported that 89% of large property and casualty insurers and 60% of midsize property and casualty insurers planned to migrate applications to the cloud in 2023. Solution providers have adjusted to this preference; nearly all vendors in this space offer a Software-as-a-Service (SaaS) subscription platform deployed on the cloud.

Insurers have been steadily increasing their cloud spend over the last few years, and there is no indication that this trend will slow down. In its report “Property/Casualty Insurer IT Budgets and Projects, 2023,” Datos Insights reported that 89% of large property and casualty insurers and 60% of midsize property and casualty insurers planned to migrate applications to the cloud in 2023. Solution providers have adjusted to this preference; nearly all vendors in this space offer a Software-as-a-Service (SaaS) subscription platform deployed on the cloud.

While the initial cost of cloud deployment seemed to be a hurdle, most insurers have come to realize that adopting cloud offers benefits such as increased scalability, better security, improved upgrade and service time, and more advanced capabilities to better keep up with their competitors. While vendors still offer support for their on-premises clients, most solution providers in this space are rolling out updates and new capabilities only to their cloud versions.

That practice shift by vendors is not without reason: Cloud platforms have more to offer customers than traditional deployments. On top of the benefits already discussed, insurers who participated in Celent’s video interview series “In Their Own Words: Insurers Discuss Their Journeys to the Cloud,” noted additional benefits from cloud such as better agility, the ability to conduct more iterative testing and deployment, and easier integration opportunities with other platforms, among others.

It’s clear that using cloud-based solutions has become table stakes in insurance rather than the latest technology on the market. However, as any insurance IT leader can tell you, a cloud transformation of any scale is not a quick project that can be completed in one go. Engineering a strong and effective cloud infrastructure requires a strategic approach.

Why Cloud Platform Engineering Matters

In today’s environment, carriers are grappling with legacy systems, systems deployed on public clouds like AWS or Microsoft Azure, and other cloud-based solutions. A solid foundation for a cloud platform must include a strategy for organizing cloud services, managing security, dealing with networks built on a hybrid infrastructure, handling financial management, and supporting tools related to the provision and management of cloud services.

Insurers’ current IT environments are highly complex. Typically, this means dealing with siloed implementations for varying products, a wide range of tools being used across lines of business, and disjointed user experiences. To stay competitive, insurance carriers need to be able to expand their digital distribution opportunities through partner platform integrations; optimize processes, which relies on accurate and complete data collection and analysis; accelerate product development as well as rollout across lines of business and various regions; and offer a consistent, modern user experience for customers, agents, and employees alike.

Highly complex IT environments mean a plethora of tools that in-house developers and end users have to not only know about but also know how to use. If employees aren’t using all of the tools available to them, then the insurer isn’t benefiting from their presence in the tech stack. Engineering a cloud platform abstracts the complexity of these tools and makes it easier to leverage their capabilities while incorporating all of the necessary governance and enterprise standards directly into the platform. A unified cloud platform simplifies the delivery of a carrier’s goals and visions.

Simply put, an efficient cloud infrastructure requires a comprehensive and integrated set of tools, services, and frameworks that are straightforward for employees to use.

The Pillars of an Effective Cloud Architecture

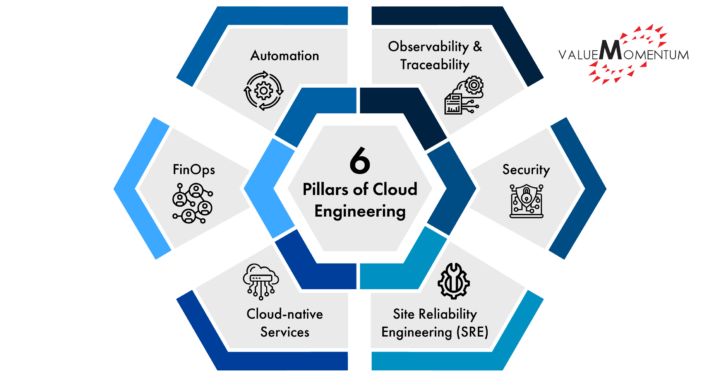

While building a cloud infrastructure may seem anything but simple, there are six pillars that can help insurers establish the foundation they need to engineer an efficient, scalable cloud platform.

When put into practice, these pillars ensure that carriers have a cloud platform that serves as a self-service orchestrator with a plug-and-play catalog; enhanced visibility and control across the infrastructure and individual applications; standardized processes that are aligned with organizational compliance measures; increased speed, agility, and reliability; and reduced costs through automation and streamlined processes.

Let’s take a closer look at the six pillars of cloud engineering.

- Automation

To operate effectively at scale, it’s important to streamline processes where possible and automate them in a way that can both tolerate the traffic and be flexible enough to change as needed. Automation can help streamline integrations and simplify back-end processes to help carriers build a best-in-class system that can provide the scale they need to prosper. This automation can even be applied to areas like governance and security. For example, an organization needs some way to restrict what users can and can’t use, to align operations and spending with a particular application or portfolio, and to ensure that the proper users have the correct permissions. When there are no checks and balances in place, an IT environment can become the Wild West.

With on-premises deployments, you might have 10 servers that you have paid for and can afford some leeway. With a cloud platform, on the other hand, automation and provisioning are critical. Cloud is pay-as-you-go. If you are paying for 10 servers but aren’t using all of them, that is a high operational cost. Automation can help carriers build governance right into the IT framework, from tags and enterprise standards to DevSecOps. With the growing reliance on cloud, automation is a critical aspect of ensuring that your team is following best practices.

- Observability and Traceability

An insurer’s IT infrastructure contains a multitude of services, which can make it difficult for operations teams to understand how to observe performance and monitor issues. On top of that, there might be different monitoring practices for various services. Cloud platforms need to be engineered in a way that enables clear observability and traceability for operations teams. If there is an error, these teams need to be alerted quickly to the issue and be able to seamlessly trace the issue to its root cause for resolution.

With so many distributed services across today’s insurance carriers, operations teams can’t successfully go to every single service to figure out where a problem has originated. They need to be given enough information on a clear dashboard so they can fix it rapidly. Modern cloud platforms should also provide self-healing capabilities; this means that if the platform detects a performance issue, it can restart on its own or revert to a previous, error-free version of the platform.

- Security

As the numerous data breaches in recent years have taught all industries, security is paramount. This is especially true for insurers, who deal with sensitive information for their policyholders. While cloud providers as well as cloud customers like insurers are both responsible for security, insurers must still prioritize their ability to offer a secure platform.

With on-premises deployments, security measures could serve as a shell around a network. If hackers couldn’t get into the network, there was no issue. On the cloud, it’s a different situation entirely. Now, we have to rely on zero-trust security, where each individual layer is secured. For cloud platforms, security should be automated as part of deployment so there is no risk across databases, communication between apps, or user access to resources within the network.

- Site Reliability Engineering (SRE)

If your services are down or if they are providing a bad user experience, it disrupts your entire business. Not only that, but with today’s partner-based ecosystem, it impacts how you are doing business with your partners, too. It is paramount to keep all tier 1 applications and services reliable for both customers and partners.

Let’s say your organization is a personal lines carrier in a region that faces an unexpected wildfire. After the fire, your claims suddenly skyrocket. If your services are not aligned and your system goes down from the increase in traffic as clients and partners attempt to review their policy information, you’re going to lose customers and alienate your agents. It is critical to engineer a cloud platform that can scale to the demand it may need in a crisis moment.

- Cloud-native Services

A few years ago, insurers used to buy software for all of the capabilities they needed, but today, everything is a service that carriers can leverage. As an enterprise, it is important to build security standards into the platform itself to ensure proper protocols are followed across all transactions and interactions.

Building cloud-native services now also prepares an organization for the future. With generative AI and other emerging technologies, these services will need to be provided as part of the cloud platform so your developers and engineers can help the organization deliver on its goals.

- FinOps

While the cost of moving to cloud used to be a hurdle for insurers, it has become clear across the industry how cloud investments pay off. However, it is still integral for insurers to focus on fine-tuning the financial management of their cloud environment. FinOps is a methodology for offering a transparent view into cloud costs across the entire organization and requires a strong partnership across the IT, finance, and business teams.

Implementing a solid FinOps strategy can include steps like identifying unused resources, decommissioning unused assets, tracking and optimizing costs, and ensuring cloud investments can clearly demonstrate a return on investment. In fact, there are more than 30 levers that can help insurers optimize their cloud spend.

Key Considerations for Engineering a Cloud Platform

While the pillars above outline the optimal framework for insurance cloud platforms, ValueMomentum always recommends that carriers individually evaluate their technical environment (including the type and number of systems an organization has in place), the IT team’s cloud engineering skills, and their business operations and strategy.

It can be just as helpful to take a look at the challenges peer insurers are encountering and the common questions the industry is asking, especially when a multi-cloud strategy is involved. Understanding how other insurers are handling obstacles and laying out their strategies can help carriers establish a cloud strategy that not only aligns with the needs of the business but also sets the organization up for success.

Learn more about assessing your organization’s preparedness for cloud platform engineering in ValueMomentum’s whitepaper “Cloud Transformation in Insurance.” You can also find more information about how our team can assist with successfully enabling a cloud architecture on our Digital & Cloud Solutions page.