Today’s insurers seek to become data-driven for good reason. The urgency has only increased with the growing promises of what a modernized data platform has to offer, such as streamlined customer experiences, unified data access, and data-driven business insights. With these advantages, insurers are aiming to drive operational efficiency, launch new products, build a presence on more channels, implement connected insurance, and more.

And yet, not all insurers are getting the data insights they need. Structural issues hinder insurers, as well as a lack of clarity in terms of what kind of foundation is necessary to build one’s data platform.

This blog explores these issues, the capabilities required for data-driven insights, and a use case illustrating how one insurer built these capabilities into their modernized data platform.

Developing these foundational technical capabilities is essential for establishing a strong reference architecture and ultimately driving critical functions in data consumption and analytics.

Building the Capacity for Data-Driven Insights

A common set of technical challenges — inconsistent data sources, aging data pipelines, and poor analytics capacity — plague most, if not all, insurers’ journeys to modernize their data platforms. These challenges principally stem from insurers’ use of multiple core systems and siloed data centers that hinder data sharing and consolidation.

The root issue behind these challenges is legacy architecture. Insurers face pressure to create new touchpoints for customer data, but legacy systems impede the use of modern data tools and technologies for streamlined analytics and consumption. Simply put, this means insurers don’t have the ability to collect the right data and apply it with the right tools.

Setting up the capacity to do so requires building a solid data foundation, one with critical data capabilities that can facilitate smoother data access and data’s translation into valuable insights.

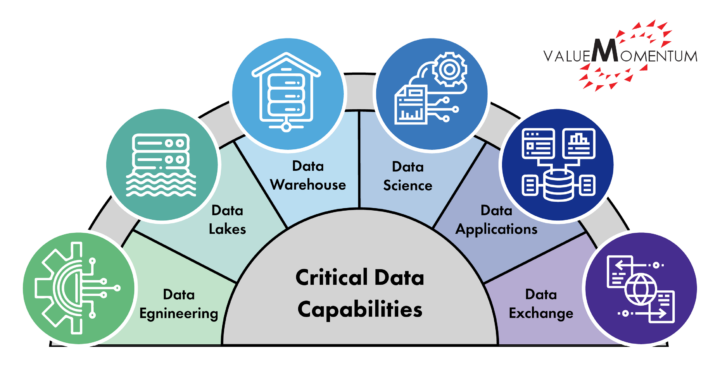

Critical Data Capabilities

Data capabilities directly address common technical challenges insurers face while also building the capacity to derive data-driven business insights. They standardize varied data sources, streamline data pipelines, and enable advanced data analytics through automation tools.

More importantly, they provide the foundation for data engineering, cloud migration, and reference architecture — key processes and blueprints to drive insurers’ data transformation.

As insurers assess their business goals and existing technology, developing the following capabilities is crucial:

- Data engineering: for ingesting and transforming raw data from multiple sources into robust and integrated pipelines

- Data lakes: to accelerate data consumption and maintain a central repository for unstructured and structured raw data

- Data warehouse: to store in-use structured data and modernize enterprise reporting with a massively parallel processing (MPP) data warehouse

- Data science: to simplify implementation processes for machine learning (ML), data automation, and artificial intelligence (AI)

- Data applications: to develop applications with fast and scalable analytics derived from smooth data flows

- Data exchange: to break down data silos and empower collaboration and sharing across the ecosystem

These capabilities ensure efficient and scalable solution delivery and data consumption in an insurance-focused solution design. Data capabilities support the entire process of deriving insight from data— a support that both addresses existing technical challenges and expands applications beyond them.

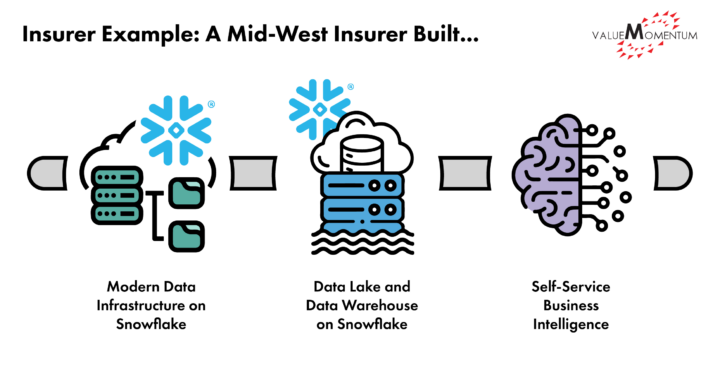

Use Case: One Mid-West Insurer’s Cloud Modernization Journey

This insurer had scattered business information across various legacy systems, relying on gut feelings rather than data for decision making. To address this lack of certainty, they determined to upgrade their data platform to a next-generation cloud-native solution. Partnering with ValueMomentum, they transitioned from legacy systems to a Snowflake-powered platform on AWS (Amazon Web Services).

The insurer built:

- Modern data infrastructure on Snowflake: A future-proof, centralized repository with scalable and robust data infrastructure and accessibility tools

- Data lake and data warehouse on Snowflake: Providing data availability and accessibility to both business intelligence and third-party applications

- Self-service business intelligence: Generating insights into current business performance and facilitating long-term planning for investments in analytical tools and skills

Leveraging proprietary accelerators and technology assets from their partners, the insurer successfully implemented Snowflake on AWS and on-premises systems, ensuring connectivity and security. They also introduced reusable metadata-driven frameworks for data ingestion, audit, and balance control. Additionally, reusable Matillion jobs were added for commonly used data quality and cleansing. This implementation provided well-defined performance measures and readily accessible information to define short-term and long-term analytics needs.

Deriving Value from Data Modernization

The digital revolution has made cloud computing and advanced analytics necessary for deriving insights and driving business value through greater operational efficiencies, enhancing digital customer experiences, and improving core insurance functions.

To keep pace, insurers must equip themselves with a strong technical foundation and address inefficiencies rooted in legacy technology, architectures, and thinking.

Insurers may need to collaborate with implementation and technology partners, such as Microsoft Azure or Snowflake, to build out these capabilities, as they provide dynamic scaling not available in homegrown technologies. Insurers can also leverage specific accelerators targeting data automation, ingestion, and historic migration to enhance speed and efficiency in their data modernization journey.

If you’re ready to begin your journey to data modernization, check out our Data Modernization Services for a Snowflake Proof of Value and an Enterprise Data Maturity Assessment to provide a jump start.