While insurance underwriting has always been critical, property and casualty (P&C) carriers have faced several challenges in this field in recent years. A growing market has increased competition across the board, and new product expectations, customer experience demands, and market entrants are changing the way people can seek out coverage.

Changing risks and regulations are forcing insurers to pull in new data sources and technologies to make their underwriting processes faster, more accurate, and more efficient. On top of this, a significant number of underwriters are hitting retirement age, leaving insurers with fewer experienced team members to handle these complexities.

In fact, P&C insurers have seen record net underwriting losses in the last few years. Deloitte reports that non-life insurers in the U.S. had a 2022 net underwriting loss of $26.9 billion — the largest loss of this kind in more than a decade. The 2023 figures showed little improvement, with Q1 2023 going down as the largest Q1 loss figure recorded.

All of these factors indicate that underwriting is an area ripe for innovation. P&C insurers are taking steps to combat these loss trends as well as to boost profitability, reduce risk, and increase operational efficiency.

Elevating Insurance Underwriting With Technology and Data

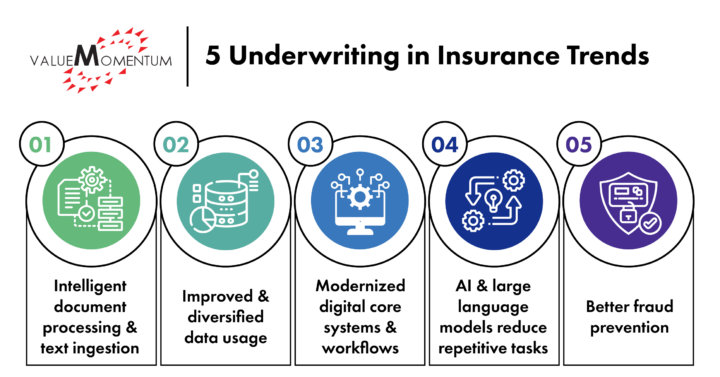

While the heart of the underwriting process remains the same, advances in the way insurers can review submission documentation and forms, leverage data, enhance their workflows, and more are helping streamline underwriters’ jobs and generate more accurate policy decisions. Here are five areas seeing greater investment to drive efficiency and accuracy in insurance underwriting.

1. Intelligent document processing and text ingestion

Underwriting involves numerous types of documentation and forms, and historically these have all been submitted on paper. While digitalization of forms has helped reduce the number of papers some underwriters have to sift through, the process of underwriting remains heavily manual compared to other aspects of the insurance value chain, making efficiency and accuracy difficult.

Technology like intelligent text ingestion and other forms of artificial intelligence (AI) are helping insurers extract multiple formats of data from documents and then process it at a more rapid rate than humans can alone. This data can then be transferred to carriers’ core systems through application programming interfaces (APIs). For example, COUNTRY Financial built a new business application for its commercial lines that cut down on data entry. It was able to reduce its new business submission time to ten minutes, down from half a day. The insurer has since reported its highest new business premium totals in ten years.

2. Improved and diversified data usage

On top of new methods of extracting data, insurers are investing in better ways to store, analyze, and apply insights from their data. Property and casualty carriers are increasingly working with third-party data like credit scores, Internet of Things scores, and even things like better climate data on top of their own institution’s data to get a fuller picture of a policy applicant.

For example, a Fortune 500 property insurer was able to fine-tune its process for underwriting its homeowners policies by incorporating aerial imagery data and AI into its processes. With these tools, the carrier was able to detect roofs that were damaged and swimming pools that hadn’t been documented in policy applications to re-underwrite upward of 12,000 policies. Savings are estimated at more than $20 million.

3. Modernized digital core systems and workflows

Digitalizing as much of the underwriting process as possible enables insurers to integrate the data collected with the rest of their core systems, eliminating data siloes and speeding up underwriting timelines as well as claims and other processes. Streamlining the workflow with digital processes also adds a level of consistency to the guidelines underwriters are using to make decisions on applications.

For some insurers, modernizing their processes means making the move from on-premises core systems to cloud deployments or, if they’ve already made the move to cloud, modernizing their cloud-based applications to be better integrated across the organization for more efficient processes. Tokio Marine HCC, for instance, was able to reduce its submission to issuance turnaround time by 75% after launching a cloud-based straight-through processing portal.

4. AI and large language models to reduce repetitive tasks

Generative AI has been a dominant theme in conversations across the insurance industry in the last year. While there are use cases across the insurance value chain, underwriters are finding particular value from applying assistive technology to their workflows. Some insurers are already leveraging technology like large language models (LLMs) as a co-pilot for underwriters, especially those newer to the field who may need more help getting up to speed

These LLMs can also assist underwriters with risk assessment or content generation. New insurtech startups are even emerging in this field, such as Sixfold, which asserts that it can help insurers streamline their risk assessment and underwriting by consolidating data from third-party sources, identifying patterns, and presenting that information in underwriters’ preferred format.

5. Better fraud prevention

While claims may be the first thing that comes to mind when talking about fraud in insurance, personal lines insurers are also seeing an increase in underwriting fraud. Tactics like identity theft, policy hijacking, and false declarations or misrepresentation can lead to harming actual policyholders, insurers, or both parties. Given the volume of insurance applications, underwriters may not always be able to spot when something is amiss in a policy submission.

To ensure they’re not falling prey to criminals leveraging digital and data capabilities to suit their needs or missing key information on legitimate applications that could change the final decision and premium, carriers are investing in fraud solutions across functions. Leveraging fraud solutions for areas like underwriting ensures that carriers can verify identities and data as well as detect and prevent fraud attempts in underwriting, customer service, and claims.

Innovation Benefits Insurers and Customers

As a critical part of the insurance life cycle, innovating the underwriting process can yield major dividends for insurers. Automating manual processes where possible, pulling in new and improved sources of data for more accurate quotes, and adding steps to make underwriting more secure for policyholders and insurers alike can make for a more efficient, accurate process for all involved.

To dive deeper into how a global property and casualty insurer accelerated and improved its underwriting workflow, read our case study “Global P&C Insurer Uses AI-enabled Technologies to Automate Claims & Submissions