Data has emerged as an instrumental differentiator to achieve critical business goals, including new products and distribution channels, geographic expansion, and personalized customer experiences. The journey to data modernization has never been more urgent, with valuable insights ready to be applied to finding new business.

Challenges, however, abound. In our recent webinar, three data executives from Snowflake, ValueMomentum, and Westfield Insurance, gathered to discuss these challenges as well as tactics and insights on the state of data and its usage in insurance today and beyond.

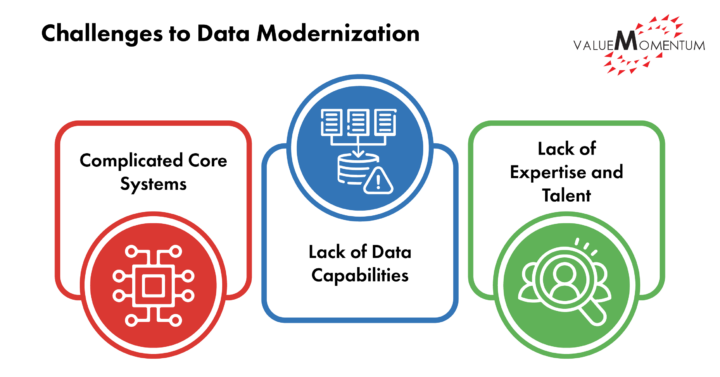

Challenges to Data Modernization

For most insurers, modernizing their on-premises data ecosystems and leveraging the scalability, flexibility and advanced analytics capabilities of modern cloud platforms is the first priority. While insurers have set this as a goal, success has been hindered both by technical and cultural obstacles, including:

- Complicated core systems. Insurers often cover a wide and diverse portfolio, and their core functionalities are spread across a number of systems. For example, an insurer may have a Guidewire policy system, a Duck Creek claims, and Insurity billing system. Complicated data ecosystems hinder any useful analysis for business and require a more organized taxonomy and catalog of data. To derive practical data insights, insurers must create a single source of truth for insurance metrics and integrate these diverse core systems for simplified access and delivery.

- Lack of data capabilities. Most insurers lack proper data capabilities to support a technical foundation with streamlined data storage and engineering tools. This goes hand in hand with the challenge of multiple core systems. Insurers need to store data in structured, robust, and scalable warehouses, organized by subject area, such as policy claims or billing. This data must also be structured for efficient access, which means building a consumption layer that accounts for various personas of business users. Such a foundation is also critical to streamline data pipelines and access enterprise wide.

- Lack of expertise and talent. Because data modernization initiatives tend to take an extended length of time, finding the long-term data analysts to maintain and derive value from these data systems is also a pain point for insurers. They may also mistake technology implementation as the end goal, overlooking the need to grow talent and build expertise. Fostering a data culture will need more than a technical data foundation and advanced analytics tools. Insurers must educate business users beyond current practices and consistently imbue the value potential that data offers across business as a whole.

Insights on Data Strategy and Platforms

Building a data platform that caters to the prospective goals of each insurer is no easy feat, but identifying a sound data strategy and the right platform are good first steps. Data executives from Snowflake, Westfield, and ValueMomentum offer the following tips and experiences to guide insurers intent on beginning their data modernization projects:

- Be specific about your business goals and use cases. Identifying the particular set of use cases will set up business teams to get relevant insights and make decisions based on available data. The capacity to build, train, and deploy new operating models depends on the specificity of these early steps, which will allow insurers to fine tune both the implementation and execution of their data architecture.

- Westfield centered on operational efficiency and process optimization as their focus of their data strategy. Leveraging Snowflake as their data analytics platform with Guidewire Cloud for policy issuance, claims and billing, Westfield successfully integrated data from various sources into Snowflake’s relational tables. This enabled efficient financial reporting and operational analytics, providing metrics and KPIs (key performance indicators) for underwriting, operations, and claims. They also prioritized information governance and security, designing a specialty reference data management system for a streamlined access point. Westfield has established a foundation for future advanced analytics and emphasized data quality through thorough checks, balances, and validations at every stage of their business processes.

- Utilize the resources of a cloud-native data platform. Insurers must pay attention to resources, such as stable pipelines to deliver data from transactional systems to analytics systems, as well as the ability to share and access data across organizational boundaries. Especially for insurers aiming for a 360-degree perspective of customers, collecting third-party data is valuable for creating detailed customer profiles and improving analytics capacities throughout all core functionalities. As a cloud data platform, Snowflake allows data sharing across organizational boundaries without moving and integrating data with existing on-premises platforms. Partners to Snowflake can access third-party data securely across the marketplace of more than 1800 data providers, allowing an expanded avenue for analytics insights for more reliable business processes. With its recent acquisition of Streamlit, a creator of open-source tech to build data-based apps, Snowflake empowers data science and analytic communities to construct end-to-end applications within the Snowflake platform. This allows for the development of predictive features and data-driven outcomes directly within Snowflake.

- Democratize data across the business and various sources. Democratization is two-fold: to expand data literacy across business users while diversifying the types of data consumable for analytics. Insurers keen on the future of data will need to prioritize how to implement dashboards and up-to-date statistics for all lines of business, enabling performance analysis by month, underwriter, bookings, quotes, bindings, etc. Equipping key business users with tools and education as well as dedicating investment towards new data sources will be meaningful differentiators for insurers. Snowflake is paving the way toward alternative data, including IoT (Internet of Things) data beyond telematics, such as home security, wearables, and water sensors. The potential of using aerial imagery combined with machine learning and AI (Artificial Intelligence) to extract features like roof conditions, materials, geometry, and vegetation is particularly potent for insurance to enhance risk assessment, customer segmentation, and claims handling. Westfield also aims to expand their data capacity, focusing on enabling real-time data via Snowflake Data Lake and Guidewire’s CDA to provide underwriters, actuaries, and finance professionals with timely information for book closure and analytics. Future plans include providing real-time data accessibility to all underwriters and team examiners, ultimately enhancing decision-making capabilities.

Preparing for the Future of Data

A data-driven ROI approach is more than an add-on to existing systems. It requires a fundamental shift towards data sharing and collaboration, both within organizations and external partners. It means to emphasize the value of data over data itself, underscoring the long-term growth potential data modernization can result in over limited project goals. In such an evolving landscape, an agile mindset will be critical for insurers while welcoming the expanding possibilities of data.

Using Snowflake’s cloud data platform and ValueMomentum’s implementation services, Westfield has positioned itself at the forefront of the industry’s data modernization revolution. For insurers interested in pursuing a personalized data modernization journey of their own, check out our data modernization services for a data platform modernization workshop and more.