Insurers know that data analytics can fuel better decision-making, help streamline processes, and tailor customer experiences. And while carriers have no shortage of data in their systems, it’s not always clear how to turn that data into insights they can use to optimize the processes that run the business, maximize opportunities to grow and become more profitable, and accelerate transformation.

But learning how to leverage insurance analytics effectively can have major positive outcomes. When done well, analytics can help insurers improve their loss ratios, increase new business premiums, and boost retention rates.

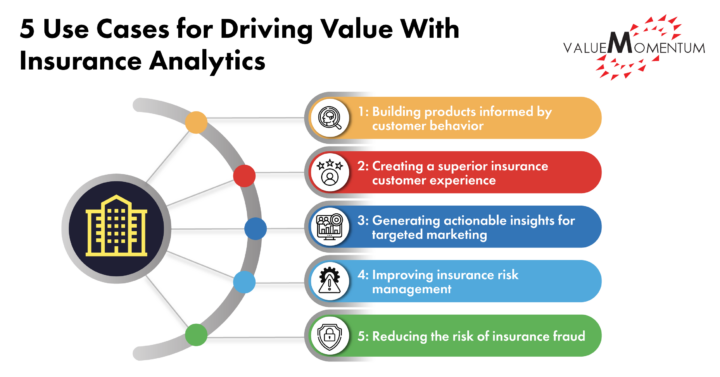

Here are five use cases for insurance analytics that can help insurers achieve better business outcomes across the entire insurance life cycle.

1. Building Products Informed by Customer Behavior

In the current insurance climate, customers increasingly expect always-on, multi-channel, and hyper-personalized experiences. Being customer-centric is no longer a strategic advantage but a business necessity.

There is a wealth of customer data readily available for insurers to analyze and distill into actionable insights. Natural language processing, or text analytics, can be utilized to build data engines that mine social media platforms and review websites, for instance, to discover what insurance customers are discussing in real time.

Whatever insurance analytics technologies or tools insurers deploy to gather and interpret data, the key to success is leveraging those data insights to build user-friendly, customer-facing applications, craft customized communications, and create innovative products and services that speak to what customers actually care about.

2. Creating a Superior Insurance Customer Experience

Beyond personalized products and services, insurers are charged with delivering high-quality insurance customer experiences. Customers overwhelmingly expect personalized recommendations, fast response times, and cross-channel consistency. They increasingly interact with insurers through digital channels such as mobile apps, which carry the additional expectation of always-on, 24/7 support.

To help ease this burden, many insurers rely on chatbots to respond to customer queries nearly instantly, with answers informed by analyzing customer buying and behavioral data. Chatbots can also supply contextually relevant insights, educate customers on process flows, compare insurance policies, and ultimately suggest the right insurance coverages. Powered by insurance analytics, conversational chatbots deliver personalized experiences, including product quotes and insurance claims feedback.

Historically, auto insurance customers would phone into a call center and experience long wait times and transfers to multiple departments. This understandably led to customer dissatisfaction — especially during the first notice of loss (FNOL) period — which impacted customer churn. With more modern tools like mobile apps and sophisticated insurance analytics, however, insurers

3. Generating Actionable Insights for Targeted Marketing

In the age of digital media, insurers have a variety of targeted marketing tactics to employ — including email nurture campaigns, text message notifications, social media posts and ads, and in-app engagements — to attract new customers and engage existing ones. Insurance analytics provide the data insurers need to craft those proactive, personalized, and targeted messages that speak to customers and convert prospects.

Through consolidating customer search data, insurers can organize this massive well of information into digestible parts, discern patterns like buying behaviors, and create incredibly targeted — and therefore incredibly effective — messaging for their customers.

They can also leverage customer lifetime value (CLV) data to break their customer base down into personas to understand how these campaigns perform in real time. Whatever tactics insurers prefer, data analytics offers a broad array of targeted marketing opportunities.

4. Improving Insurance Risk Management

Underwriters used to be limited to inflexible, predefined guidelines; simple statistical models, such as profiling and scoring; and their own experience and intuition to calculate risk. Now, underwriting is evolving. Insurance risk managers have an abundance of internal and external data to inform their risk assessments, as well as insurance analytics to help organize and interpret it.

A customer’s profile, for instance, can be reviewed for a precise, defined time frame by analyzing historical data from credit agencies, third-party vendors, and social media activity. Insurers can develop a broad, full-spectrum perspective of their customers and intelligently rank their relative risk profiles through a far more accurate data-driven approach.

Insurance analytics provide the key to more precise — and ultimately more profitable — risk assessments, making insurance risk management one of the most impactful use cases for insurance analytics today.

5. Reducing the Risk of Insurance Fraud

While every company must protect itself from fraud and abuse, the insurance industry is especially vulnerable to these risks. When insurers suffer fraud and experience losses, these losses tend to pass onto policyholders in the form of higher premiums.

Through using predictive analytics and reviewing historical and customer behavior data, insurers can recognize suspicious patterns that indicate fraud. This process can even be automated to a degree by setting pre-defined conditions and then programming the claims process to automatically flag claims that meet them. Artificial intelligence and machine learning algorithms are particularly effective in the fight against fraud because of their pattern recognition capabilities.

Leveraging insurance analytics to reduce fraudulent claim payouts can save insurers a considerable amount of money, which can then be applied to the customer in lower premiums — improving customer satisfaction and loyalty in an increasingly competitive industry.

Investing in Insurance Analytics for the Future

Between evolving customer demands, new regulations and technologies, and a host of other challenges, it’s more important than ever for insurers to claim every competitive advantage.

Investing in insurance analytics is a low-hanging fruit. Analytics provide actionable, real-time, and highly accurate business intelligence across a variety of use cases, from helping create better customer experiences to empowering underwriters to develop precise risk profiles.

Analytics will only become more important as the insurance industry continues to mature digitally to enable carriers to optimize their processes, maximize their chances to grow their business, and accelerate their business transformations.

Ready to start investing in insurance analytics, or to mature your data and analytics capabilities? Check out our whitepaper “Driving Business Value With Insurance Data Analytics” to learn how to drive long-term business results with insurance analytics.