In the rapidly evolving landscape of property and casualty insurance, customer communication management (CCM) systems are pivotal for providing a good user experience. From policy quotes and endorsements to billing and compliance disclosures, CCM systems handle a vast array of information, distributed across both traditional and digital channels. They also play a crucial role in creating, delivering, and storing customer correspondence.

CCM systems ensure that all customer interactions, whether outbound or inbound, are managed effectively and efficiently, aligning with modern customer expectations while maintaining compliance and accuracy. To do this, insurers need to continuously evolve their customer communications capabilities and experiences.

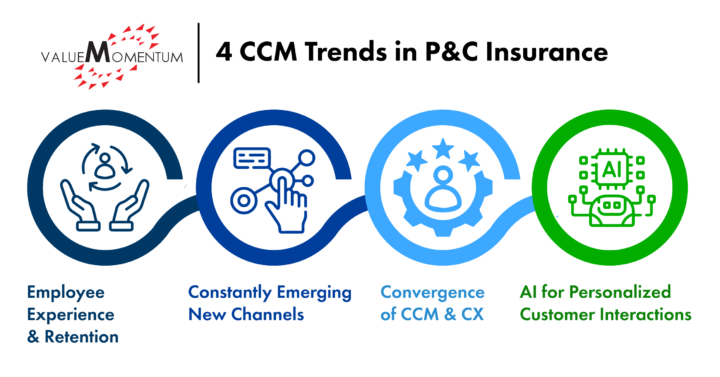

Top Trends in Customer Communication Management

Here’s a look at four customer communication management trends that are shaping the future of property and casualty insurance.

1. The importance of employee experience (EX) and retention

One of the most compelling trends we’re seeing is the impact of CCM technology on employee satisfaction and retention.

More than 25% of employees with some level of responsibility for customer communications reported actively looking for new jobs or being likely to leave according to a recent report. The leading cause of their dissatisfaction was outdated software.

For insurers, this should be especially concerning given rising expectations around hybrid and remote work, the average age of insurance industry employees and the rate of retirement, and the potential loss of institutional and domain knowledge when more senior employees leave.

By simplifying data access and streamlining communications processes, insurers can reduce friction for current employees, accelerate effective onboarding of new hires, and more readily attract business and IT talent.

2. Constantly emerging new channels

As insurers begin to move away from the expense, delays, and limitations of call centers and paper communications, the ability to manage and integrate an expanding array of communication channels is about more than just meeting customer expectations.

Our everyday digital ecosystem continues to expand, which makes integrating new channels into the omnichannel experience crucial for staying connected with insureds, agents, brokers, and other partners. On top of staying connected, the evolution of digital communications is marked by a shift from simple text to more engaging formats, including interactive dashboards, more advanced chatbots, voice assistants, and even immersive technologies like virtual reality. These tools offer users a more interactive experience that aligns with rising expectations set by other industries.

This shift presents several challenges. Insurers must not only ensure seamless integration across various platforms but also maintain the quality, compliance, and personalization of communications across all channels.

The goal is to create a cohesive-yet-flexible omnichannel experience that resonates with customers and partners across their preferred — and changing — touchpoints. As digital preferences evolve, insurers must remain agile, continuously adapting their strategies to include new and scalable technologies and communication methods. A proactive approach to expanding and refining omnichannel capabilities will set successful insurers apart from the rest.

3. The convergence of CCM and CX

As customer experience (CX) becomes increasingly important for attracting and retaining customers, customer communication tactics are converging with overarching CX strategies. In addition to improving the quality, relevance, availability, and personalization of customer and partner interactions, incorporating CCM into the greater CX strategy helps insurers deliver a seamless brand experience.

This integration requires a comprehensive approach that includes evaluating current CCM solutions, identifying communications touchpoints, and incorporating all of them into customer journey maps and CX metrics.

The trend of combining CCM and CX is driven by the recognition that traditional customer communications are critical components of CX. And yet, they’ve historically been siloed or overlooked within insurance companies, leading to disjointed and frustrating experiences as well as lower customer satisfaction and retention rates.

Insurers that successfully integrate CCM and CX can expect several benefits, including faster sales cycles, lower call volumes, and higher customer satisfaction rates due to clearer communications. In addition, a well-executed CCM/CX strategy can lead to increased customer retention, partner and customer loyalty, and operational savings due to lower error rates, which in turn reduce effort and waste.

4. AI for personalized customer interactions

If accurate, real-time, personalized interactions are the ultimate goal, then artificial intelligence (AI) is emerging as the ultimate enabler of CCM.

AI capabilities are already helping insurers connect with and understand their customers better and improve customer satisfaction and loyalty. While this list is sure to expand, here are a few of the ways AI is helping insurers offer personalized interactions:

- Customer Segmentation: AI allows insurers to segment customers based on factors like demographics, preferences, behavior, and risk profiles. This enables the creation of more accurate customer segments that reflect individual needs and expectations.

- Product Recommendations: By utilizing natural language processing and advanced chatbots, insurers can interact with customers in a conversational manner to understand their goals, challenges, and preferences. AI can recommend the best products and services for each customer based on personal data and preferences.

- Personalized Engagement: AI helps insurers engage with customers in a personalized way by providing 24/7 customer service through chatbots. This allows for answering questions, resolving issues, and providing advice in addition to delivering personalized content like tips, alerts, rewards, and incentives.

- Efficient Claims Processing: AI and machine learning can be used to flag claims based on certain attributes and route them for more detailed reviews or touchless processing, for example, making it faster and more efficient. Policyholders receive timely reimbursements for expenses, reducing financial stress.

- AI-Driven Customer Journey: AI enables insurance companies to provide the right service from agents to customers based on personal data, preferences, behavior, risk profiles, and demographics, improving speed and accuracy and reducing paperwork and friction across channels.

By leveraging technology like conversational AI, insurers are enhancing their CX by providing quick access to information, personalized recommendations, efficient claims processing, and proactive engagement through various channels like chatbots and virtual assistants.

Jump-starting Your Customer Communication Management Effectiveness

These are just some of the CCM trends that are driving insurers’ success in customer communications today. The digital era requires insurers to constantly optimize their customer journeys, evolve in response to growing data availability, and adapt based on customer input across a growing number of digital channels.

To win in this hyper-competitive era, insurers must be able to harness modern CCM technologies and effectively integrate them with new and traditional data sources, including insurance core systems, AI and analytics, and cloud-based solutions to offer greater operational efficiencies and seamless digital experiences.

To see how a multiline insurer built a digital core and improved customer experience through CCM modernization, read the case study.