The advent of technologies such as Artificial Intelligence and Machine Learning has spurred new demands for quality products as well as new possibilities for improved operations. Insurers face an intense challenge to keep up with the pace of digital transformation—all while reducing costs, speeding product cycles, and providing rich personalized experiences for customers. Quality Engineering (QE) has emerged as a critical strategy for insurers to tackle this challenge and drive business outcomes. However, for many insurers QE still remains an amorphous concept with multiple layers and processes. This blog will illuminate further the basic definition of QE and the guiding approaches that underlie a sound QE strategy with automated testing at the center.

What is Quality Engineering?

Quality Engineering and the equivalent concept of Quality Assurance (QA) can be summed up into this simple equation: Extreme Automation + Continuous Testing. Extreme automation is a framework that underscores automated testing and real-time analytics across all stages of production. Insurers—especially ones that still rely on legacy systems and primarily manual testing—often reserve testing as the last step in a product cycle. A sound QE strategy, however, will incorporate continuous testing across UX, APIs, and more to facilitate constant feedback for errors and bugs through automated tests.

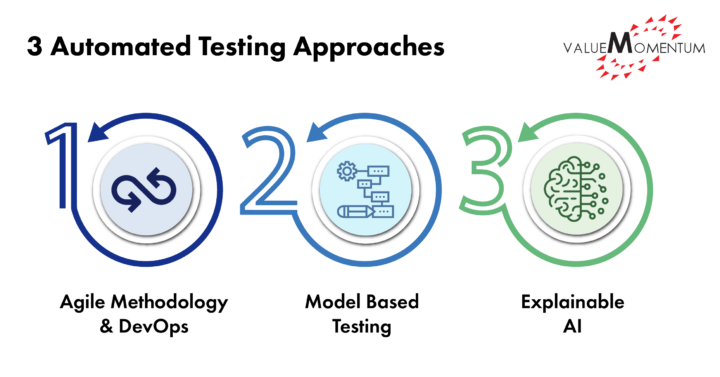

Three Key Approaches to Automated Testing

-

Agile Methodology and DevOps

Agile Methodology itself is now widespread in the insurance industry, but an automation-informed Agile approach remains unexplored—and underutilized—territory for many insurers. This approach emphasizes iterative development that puts automated testing and feedback within each step of the product cycle. It can be broken into three stages: inception, development (sprints), and stabilization. Engineers design and refine the required automated tests during inception. They then conduct these tests in short periods of time called Sprints, which demarcate points of feedback and review. Once these sprints are complete, development conducts further testing—such as regression testing, end-to-end functional testing, performance testing, and user acceptance testing (UAT)—as part of the stabilization stage. Automation-informed Agile accommodates for early defect detection, reduces the time needed to fix defects, and supports daily builds that reduces costs and adheres to a planned schedule.

Inextricably linked to this Agile approach is DevOps, the marriage of software development and IT operations. An Agile approach is not enough to resolve the issue of infrastructure management; speedy product cycles require multiple deployment environments and constant provisioning to prevent environment drift and costly business waste. DevOps that incorporates both automated provisioning and testing maximizes all the tenets of continuous testing: continuous integration, continuous quality, and continuous deployment. As insurers fully incorporate automated tests into build, regression, code quality & coverage, etc., they reach closer to what is called DevOps maturity—the key to faster and more efficient product cycles. -

Model-Based Testing

Testing against the pressures of constant revision, integration, and deployment carries its own margins of error, including manual labor that can slow the product cycle. Model-Based Testing (MBT) goes hand in hand to fix this risk and automatically test applications and environments in a controlled amount of time. MBT uses models to generate test cases, which function as an abstract representation of how the system is expected to behave in a real-life user experience. It allows insurers to trace all the facets of testing—from requirements and code to models and test scenarios—and produce solid test coverage and accuracy.

Engineers first create a visual design that models business scenarios and incorporates a mechanism to capture variations within the scenarios. Accelerators further define and import constraints and rules within the scenarios. Next, the system automatically generates varied test scenarios that are optimized through combinatorial algorithms. Finally, the tests are conducted through multiple test execution platforms such as Selenium of STS. Models—not code—support the change management. MBT allows clear traceability to test requirements and automated defect entry, improving both operational efficiency and user experience for customers. -

Explainable AI

AI and its accompanying automation tools carry extraordinary potential for insurers in both testing and the overall claims processing. They also have their risks however. Potential bias and discrimination from AI models can inhibit the efficacy of product cycles and fair underwriting practices. That is why Explainable AI—as both a set of methods and processes—serves as a foundational approach for insurers to ensure accuracy in testing, commit to fairness, and build trust among customers as part of their QE strategy.

Explainable AI emphasizes comprehension of data. Humans must be able to interpret the output produced from machine-learning algorithms and understand why a model took a certain decision. This does not mean that automation does not play a role within the “explainable” part of AI. As an example, AI based Automated Defect Triage (AIDT) can analyze the descriptions of defects and predict their root causes. It conducts a defect analysis within defect reports and creates a cluster of key words that are automatically associated with a respective functional area. Thus, the model automatically analyzes future defects and eliminates the need for manual defect triage. AI Models themselves require automated testing to ensure quality and speed for product cycles.

Powering business growth with Quality Engineering

At its core, QE combines extreme automation and continuous testing to maximize quality assurance. These approaches—Agile/DevOps, Model-Based Testing, and Explainable AI—all function as a key foundation for a sound QE strategy. They not only serve as guiding structures, but also dictate the key methods and areas of testing relevant to insurers. Ultimately, securing this foundation will allow insurers to reap faster product cycles, achieve operational efficiencies across underwriting and claim processing, and effectively expand their customer base.

Ready to jumpstart your Quality Engineering Journey? ValueMomentum helps customers implement the proper methodologies and structures to secure a solid QE foundation. Learn more about how VM can improve upon your existing insurance testing capacities while expanding organization-wide quality engineering capabilities.