Enterprises that put customers at the heart of their business are embracing new and innovative technologies for customer experience—to attract, engage and delight their customers—and thereby drive business growth. According to Forbes, two-thirds (66.66%) of a company’s competitive edge comes from its customer experience. Accordingly, 67% of consumers and 84% of business buyers said they’d be willing to pay more for better experiences. Given these statistics, it becomes very clear that providing exceptional customer experiences should be one of the top priorities for any business.

In insurance, customer experience and digital transformation go hand in hand. At the heart of insurers’ efforts to modernize their IT infrastructure and streamline their business processes is their goal of reshaping experiences for all—policyholders, employees, agents, and partners alike. Let’s take a look at how some emerging technologies are being used to reshape the customer experience in the insurance industry.

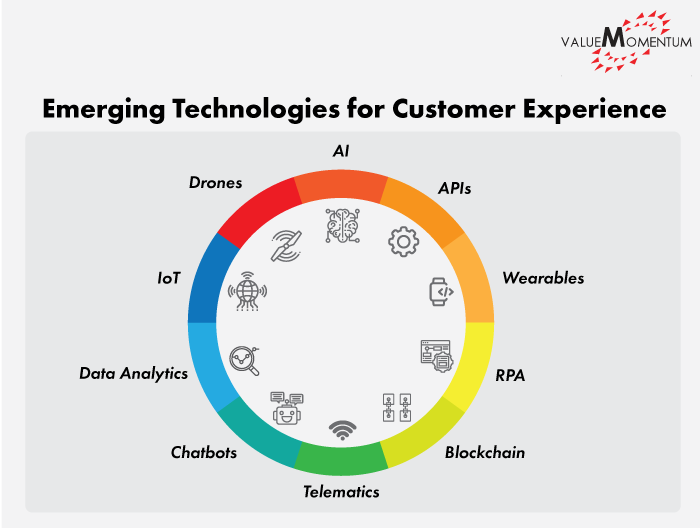

How insurers are leveraging emerging technologies for customer experience

Achieving speed & accuracy with RPA

Insurers are tapping into RPA (Robotic Process Automation) to automate high-volume, repeatable tasks and reshape customer experiences, internally and externally. In the health insurance space, when a provider applies to join a network, each application can span up to 26 pages and contain more than three dozen fields. Moreover, the application requires a rigorous series of checks to verify credentials and the accuracy of information provided. Before RPA, multiple employees on the network side used to process this application manually, with the added stress of knowing that even a single error might result in huge fines.

RPA technology streamlines and automates this process by ensuring that insurance provider’s applications and renewals are processed efficiently, timely, and without compliance concerns. A simple example is moving data from a repository of insurance policy applications to trigger case creation and underwriting processes with pre-filled data. If done by an employee, this task would require handling hundreds of files, daily. RPA Bots speed up this process, eliminating human error and increasing processing volume by approximately 300%. The result? More satisfied customers, faster approvals, and less stressed employees.

Personalizing risk predictions with AI

Insurers are leveraging the power of AI to derive intelligent data-driven insights to more accurately analyze, predict, and personalize risk. AI allows insurers to gather, analyze, and match massive amounts of data quickly to make more precise underwriting decisions and improve customer satisfaction via more personalized policy offerings.

For example, a life insurance underwriter can use AI capabilities to automatically incorporate information about customers’ lifestyle factors (e.g. prescription drug history, gym membership, shopping habits, and travel plans) to offer customized plans that reward and incentivize low-risk, healthy behaviors. By integrating themselves with their customers’ daily lives, insurance companies can better meet the demand for winning, personalized experiences that today’s digital consumers seek.

Creating positive experiences with Data Analytics Tools

Data analytics tools are instrumental in making quick, insightful decisions that increase customer satisfaction and provide necessary business development support to agents/employees. Insurers are applying these analytics tools to the data they collect from telematics, agent interactions, customer communications, smart homes, and social media to better understand and manage their relationships.

With regard to customers, insurers are collecting and analyzing data from telematics and smart home technology to further customize policy premiums. By utilizing data analytics tools, insurers can underwrite based on a more customized risk profile, allowing them to provide cost-savings in the form of reduced car insurance premiums for safe drivers, and better insurance rates for homeowners who have multiple security measures installed in their homes. As customer satisfaction is a strong predictor of customer loyalty, offering discounts is one of the ways insurers can build a winning relationship with policyholders.

When it comes to agents, insurers are adopting relationship management tools to pull data from policy administration systems into a single location for a complete view of sales performance. The insights gathered from this data is often presented graphically to allow management to support their agents in multiple ways including coaching, giving tips, and adding or removing geographical territories from their agents’ portfolio. By offering real-time business development support, insurers can help agents improve their skills and work more effectively to grow their book of business.

Improving customer experience is an ongoing effort

RPA, AI, and data analytics tools are just a few of the emerging technologies available to insurers. When it comes to leveraging the capabilities that these tools can provide for customer experience, insurers have only begun to explore the tip of the iceberg. As insurers continue further along in their digital transformation journeys, devote more time and resources, and become more comfortable with these tools & technologies, they can unlock increasingly advanced capabilities to truly address the demands of their internal and external digital customers.

ValueMomentum offers IT services and software solutions to drive digital & cloud, data and core transformations to insurers in North America and South Asia. Learn more about how we can help your firm elevate customer experience with cutting-edge technologies.