The demand for quality products and services at the speed of digital continues to pressure insurers to redefine their quality assurance & testing practices. As customer expectations rapidly evolve in an increasingly competitive market, insurers struggle to maintain high frequency of releases and enhancement processes and provide personalized coverage. In this landscape, quality engineering (QE) becomes key for insurers. QE involves having a comprehensive quality assurance and testing strategy, one that puts extreme automation at its heart. A sound QE strategy will allow insurers to improve testing efficiencies, accelerate speed-to-market, and provide a seamless customer experience without glitches. By deploying cognitive technologies such as artificial intelligence (AI) and machine learning (ML) in their QE, insurers can further drive business outcomes and gain competitive advantage.

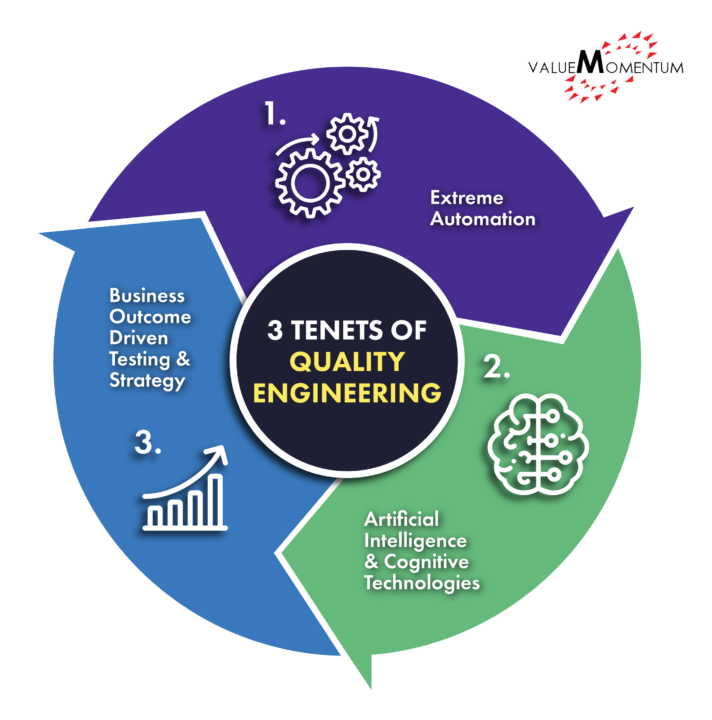

What are the Three Tenets of Quality Engineering?

Quality Engineering aims to build a high performing & agile organization that is capable of meeting business outcomes through efficient insurance testing. This encompasses optimal quality assurance, end-to-end test automation, and predictive analytics. It reduces the likelihood of defects and mitigates technical debt, enabling insurers to best deliver a desired product or service. It brings the capability to achieve first-time-right product releases, to enhance the overall efficiency of quality assurance, and more. Let’s look at the three tenets of Quality Engineering:

Extreme Automation

Extreme automation involves a confluence of multiple disruptive technologies to bring automation to all processes and application components. This includes automating build verification, smoke and regression tests, underwriting, and testing of all touchpoints for both insurers and customers. As insurers face increasing need to release new software or products with both high efficiency and frequency, they must deal with more complex product cycles that are both labour-intensive and time-consuming. With extreme automation, insurers can consolidate the weaknesses they may have, such as legacy systems or manual back-end processes. It provides both a cost-effective and technologically efficient foundation to help insurers meet new demands and focus on long-term business goals.

Artificial Intelligence and Cognitive Technologies

Artificial Intelligence (AI), as a critical component of QE, applies advanced analysis and logic-based techniques for automation. AI encompasses cognitive technologies such as Machine Learning (ML) and Natural Language Processing (NLP), which comprises natural language understanding, natural language generation, and speech recognition. Both of these AI technologies serve to streamline software testing, especially protecting enterprises from costly errors and optimizing the insurance testing process. For example, NLP can help train a machine learning algorithm to recognize test cases written by different users for the same purpose. Gradually, the algorithm improves at recognizing the duplicates and can remove them repeatedly without bias. Leveraging AI becomes critical to “test smarter, not harder.”

Business Outcome Driven Testing and Strategy

Ultimately, a successful QE strategy incorporates efficient insurance testing that drives insurers’ business outcomes. Agile development and testing practices are a must for insurers, along with a shift-left testing approach and a strong team of Software Development Engineers in Test (SDETs) who can build robust automation solutions. By implementing Extreme Automation and AI technologies into product development and claim processes, insurers can accelerate speed-to-market, build flawless customer experiences and products, and reduce total cost of testing. As the industry evolves with the expansion of digital ecosystems, a sound QE strategy will be essential to stay competitive and produce successful business results.

How does QE drive Business Outcomes?

Quality Engineering produces intelligent solutions for insurers that maximize returns and simplify key operational processes. Now that we have learned the foundations of QE, let’s dig deeper into how QE drives business outcomes for insurers:

Increased Testing Efficiencies

Achieving better test coverage requires development & testing teams to account for numerous automated test cases, which can lead to redundancies and coverage gaps that need to be identified and optimized. Increment and execution of regression suites can also take a long time, often due to a lack of traceability between test cases and requirements. Adopting Natural Language Processing (NLP), Artificial Intelligence (AI), and Machine Learning (ML) in an insurer’s QE strategy can help IT teams generate total inventory of test cases within and across systems and provide a heat map view of TCs by state, system and coverage. This can greatly increase efficiencies in test design and execution, improve coverage with an optimized test suite, and provide a repository for QA teams to access.

Accelerated Speed-To-Market

Incomplete test coverage and minimal testing automation capabilities greatly reduce insurers’ ability to provide enhancements and releases that quickly meet customers’ expectations. By automating defect triage and smart regression testing of new features, insurers can quickly identify defects and optimize functional and smart regression test coverage. The NLP-based model automatically analyses future defects and utilizes its capabilities to associate new defects with functional areas, removing the need for manual defect triage. By also automating recommendations of test scenarios and cases, insurers can accelerate the speed-to-market for releases through early detection and removal of defects.

Improved Underwriting Efficiency and Productivity

Insurers still struggle with back-end underwriting processes that are repetitive and labour-intensive. Predictive models and machine learning algorithms can quickly resolve submissions and renewals that do not require human intervention. Automated underwriting can decrease submission turnaround time by 50% and speed underwriting decisions by 40%. Both agents and customers enjoy an improved user experience, as agents have improved underwriting workload management and customers experience faster turnaround time for claim handlings. Insurers also reduce costs with ability to make electronic commission payments and automation of new business payment processing.

Ready to embark on your QE journey?

Quality Engineering promises to bring agility with an enhanced customer experience. In the long run, QE can lead to the realization of further business outcomes such as faster turnaround time for claims, improved underwriting with straight-through processing, reduction in non-renewals, and an increase in customer retention. Hence, insurers prioritizing Quality Engineering in their IT agendas are at a definitive advantage.

Are you ready to start your own Quality Engineering journey? ValueMomentum helps customers move to a shift-left approach to enable quality early in the lifecycle while focusing on real-time results. Learn more about how ValueMomentum can help transform your testing practices and build organization-wide quality engineering capabilities.