In a landscape of continuous disruption and AI-driven innovation, insurers face an opportunity and a threat: to reap the business benefits of a modernized technological foundation, or risk becoming obsolete. The benefits are substantial, from automated workflows and streamlined operational efficiencies to quality products at speed — and more.

Critical to riding this tide of innovation is a fully digital insurance core systems platform. This includes the transition to cloud-native data and core platforms, as well as building an agile product cycle with continuous testing and automation at its heart.

However, technological enablement is not a point solution. Many insurers, notable for legacy systems, remain stuck in outdated business models and mindsets that hinder new enablement and implementation. A successfully operative digital core requires enterprise-wide investment and an organizational shift with equal buy-in from people and process. What, then, must enterprises become in order to reach a state ripe for innovation?

Already impacting industries outside of insurance, product-centric management changes one’s focus from pre-defined milestones, scopes, and budgets to iterative processes that center business outcomes. It aims to transform the experience of insurance across business users and customers.

Technological Enablement Through Shifting from Project to Product

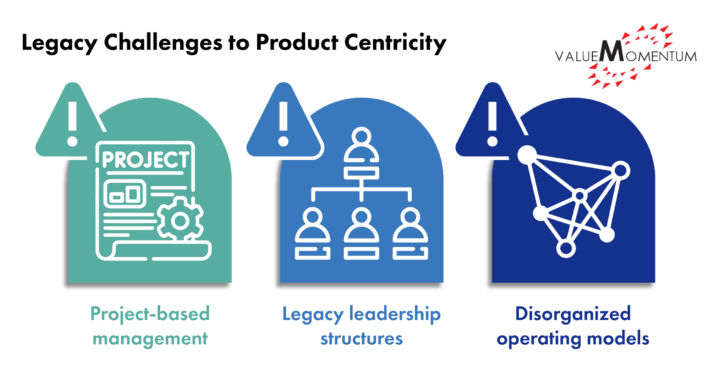

Insurers commonly mistake technological enablement as solely an IT initiative, but the business and organizational mindsets also must change in order to facilitate proper implementation and the connection between functionalities and business outcomes. Here are some existing legacy challenges that hinder insurers:

- Project-based management. Despite insurers’ growing interest in transitioning to agile product cycles, they continue to principally rely on project-based management business models. Those project-based models measure products according to their ability to be used instead of how customers will actually experience or use them. Without a clear business orientation, project-based management limits the capacity for iterative creation and continuous testing crucial for an agile product cycle. It also creates a schism between IT and business, with IT teams focusing strictly on the technical side of the equation without considering how those functionalities translate into customer experience and ROI.

- Legacy leadership structures. Old hierarchies and siloed teams are increasingly incapable of producing the complex and multi-channel customer experiences and agile product development capacities insurers need today. Leaders continue to restrict employees based on project-based limitations, which include pre-defined timelines, scopes, and budgets. Importantly, business strategy remains opaque to employees as a whole, partially due to performance metrics that only account for how functionalities are used, ignoring product outcomes altogether. Without leaders actively delegating decision making and empowering autonomous team building, employees are not incentivized to think relationally across teams and networks.

- Disorganized operating models. Reflective of insurance’s haphazard and slow immersion into modernization technologies, many insurers rely on multiple operating models without a clear alignment between IT and business units. Business outcomes become difficult to measure when individuals and teams manage separate models independently, leaving many of their functionalities underutilized. Without accountability, insurers require more manual labor to maintain these systems and even more to upgrade them.

3 Product-centric Management Focus Areas for Insurers

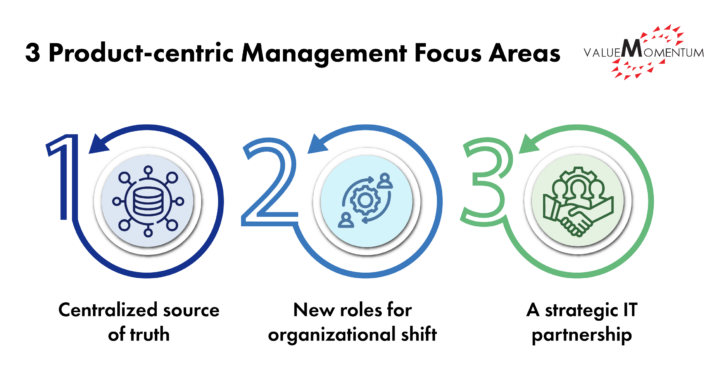

Moving from project to product requires insurers to change their previous assumptions on what constitutes effective team structures, IT and business alignment, and partnerships. Winning insurers will understand that disruptive innovation — advanced analytics, quality engineering, cloud-based core, and more — must accompany an equivalent change in the technological and people foundation of the enterprise.

Below are three areas of focus insurers must consider to transition from project to product management:

- Centralized source of truth. Applicable in both technical and organizational terms, a centralized source means having a platform that streamlines data access for business users and supports core functionalities across billing, policy, and claims. It means developing a singular operating model that fully aligns business and IT, forming a network for product teams, enterprise security, IT services, and support. Transparency is key here — no technologies are without ownership, and all teams overlap to keep each other accountable while sharing access to data insights.

- New roles for organizational shift. Product-centric management will inevitably lead certain roles, such as project managers, to become obsolete. Insurers must prepare for this transition with new skills training, mentorship, and hybrid team integration. This can start by fostering more cross-functional collaboration and then slowly building separate product teams led by product managers. Traditionally siloed teams will rely on more standardized performance metrics to encourage collaboration and shared accountability, including customer satisfaction and percentage-of-profit targets.

- A strategic IT partnership. As the insurance industry turns toward a more networked business structure to expand across regions and distribution channels, product-centric management will be critical for insurers to reap the business possibilities of an insurance ecosystem. This goes hand in hand with the gradual transition of insurers from on-premises data and core systems to cloud-native platforms, with the external service providers performing the additional legwork to implement, maintain, and upgrade systems. Insurers will need a strategic IT partner who can be embedded in every stage of product-centric teams, facilitating technology adoption and securing a connective thread across disparate technologies and a core operating model.

Paving the Way to Product-centric Success

The journey to becoming product centric is not easy. Digital cores are complex to build, and transitioning from project to product is just the first step toward reaping the business benefits of disruptive innovation. Forward-looking insurers, however, will start identifying their existing technological gaps, organizational silos, and roles to communicate the intention to change and outline a sound strategy.

Product-centric management at its core is about quality experience for both customers and business users. It empowers employees and leaders alike to become autonomous decision makers and to embed business outcomes at every step of product cycles and operations. For insurers keen on building an agile and repeatable model for expansion that centers quality experience, becoming product centric is a must.

For more information, check out our white paper “Project to Product: Quality Engineering,” to learn how our QE team can help you become product centric.