State expansion is a principal business goal for many insurers. Its opportunities are clear—the chance to develop new product lines, pursue new insurance markets and distribution models, and expand their agent network—but the journey itself is not without its challenges. Insurers must follow unfamiliar state laws and regulations, licensing requirements, and compliance procedures, all while facing competition from already established carriers.

For insurers seeking state expansion, a modernized core platform is crucial. Such platform allows reusability while being flexible towards specific policies and requirements of each state and region. A streamlined, strategic approach that centers such functions will help an insurer quickly and efficiently transform their core system.

A regional property & casualty carrier partnered with ValueMomentum’s CoreLeverage team to expedite their core system transformation. In this brief overview, we share an approach highlighting key elements of a modernized core platform geared towards future state expansion.

Use Case: Expanding Commercial Lines Business into Additional States

When this Mid-west insurer modernized their core systems years ago, they adopted Guidewire InsuranceSuite and implemented PolicyCenter, BillingCenter, ClaimCenter, and Producer Engage portal. They knew that a modern platform was going to be necessary as part of their long-term growth strategy—one that could provide them the flexibility to expand their commercial lines into additional states as well as diversify their presence beyond their region.

The challenge: the insurer needed to transform their core systems and simultaneously support existing business processes and some on-premise systems. Platform users would have to be able to operate business as usual while core systems were being modified; for example, agents would continue to have access to up-to-date policy and customer data through their agency management system. In addition, the insurer also wanted to introduce a new product with the expansion.

Key Technology: Guidewire Core System Transformation

Since the insurer was already operating on Guidewire, a modernized core system, the CoreLeverage team needed to configure the platform for a new state—implementing the rules, rates, and forms needed to support the product in the new state. The team’s approach leveraged the flexibility of the modern core system to expedite the project timeline.

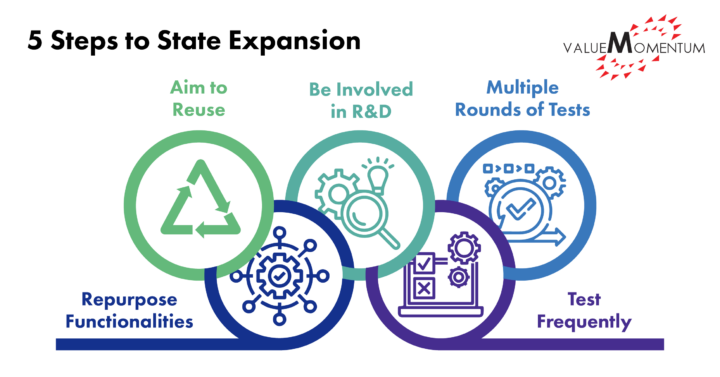

A 5-Step Approach to State Expansion

-

Aim for Reusability From Day One

Through VM’s assistance, the insurer focused on creating resources that can be reutilized for future state rollouts. A repository was created to be used for the factory model, along with documentation of all learning, problems, risks, and mitigations as well as a state roll out guide specific to the insurer. By recording the process, the insurer can expand to new states more quickly and with less risk in the future.

-

Be Involved in R&D Phases

During the pre-inception and inception phases of an R&D project, ValueMomentum worked with the insurer to better understand the business requirements for the new product they wanted to introduce with the expansion. The approach for the product was based on existing state functionalities and presented three different plans for the insurer to choose from. Being involved in the inception phase allowed for the insurer speed up product definition, which led to clearer business objectives for the project.

-

Introduce Multiple Rounds of Testing and Early Feedback

During the development stage, it was crucial to receive feedback early to ensure the end product was high quality. To achieve this, ValueMomentum introduced a pre-UAT phase that enabled the team to try various approaches with multiple rounds of testing. By starting the UAT early on and presenting different test options, the insurer gained transparency into the development process. This built trust because the insurer could see the difference between the initial smaller demos and the final, large demo. This also minimized business reliance during the UAT phase.

-

Repurpose Existing Functionalities

Using previous infrastructure allowed the team to quickly create new functionalities for the state. With any functionality that the business wanted to implement, the VM team checked to see if it resembled any of the six live states and leveraged processes already in place. For example, our team examined existing forms and decided to either modify them, replicate them, or create new forms entirely. This saved labor by repurposing already useful features and code.

-

Frequently Test Integrations

Ensuring the AMS integration remains operational during the expansion is crucial so that the insurer’s agent partners can continue to use the system without any disruptions. Because this project required frequent AMS releases, the VM team reviewed the AMS backlog constantly to identify any potential impacts. By keeping track of how changes were affecting integrations to other systems, our team could quickly resolve issues before any significant problems arose.

Setting the Stage for Business Expansion

By putting in place a clearly defined strategic approach and effective collaboration at different stages of the project, the insurer was able to expedite their state expansion project and set the stage for future expansions.

Whether you seek to grow by entering new market segments, launch new products, or expand into new geographies, Value Momentum’s team of core experts is here to help. With insurance domain expertise and proven assets and accelerators, we help insurers transform their core to drive business results.

Ready to expand into new markets? Visit our Core Leverage Services page to learn more about how we can support your company’s growth through core transformation.