In recent years, Quality Engineering (QE)—and the accompanying standard of Quality Assurance (QA)—have emerged as key concepts for enterprises to ensure the quality of their applications. A good QA/QE strategy involves continuous testing plus increased use of test automation that drive speed-to-market and operational efficiency.

Within insurance, innovative organizations are already engaging in some extent with continuous testing; many have started to utilize Agile/DevOps tools, incorporating continuous integration/continuous deployment and release management as part of their QA modernization. However, AI-based test automation remains underutilized in the industry, despite its benefits. It makes sense; most insurers are still transitioning from legacy systems, and the move to automated testing requires more than just the technology itself—it needs the right people, investment, and structure.

But how can insurers start building an automation-informed QA/QE strategy? And, what are some key areas of testing that can benefit from QA automation?

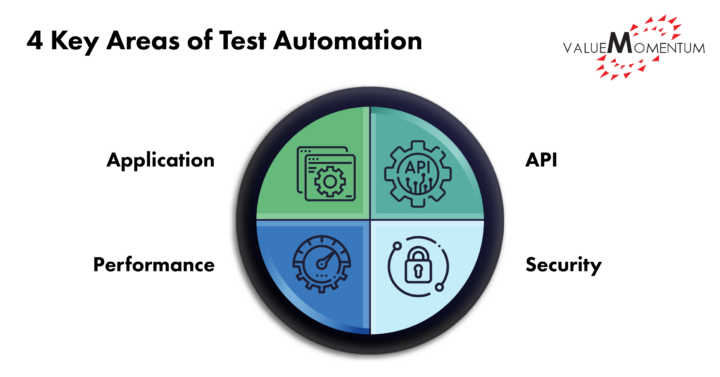

Four Key Areas to Adopt Test Automation

Testing can be divided into two categories: functional and nonfunctional. Functional testing describes the pure functions that keep an application operating, such as business processes. Non-functional testing involves the customer experience and the end-product, including UI/UX and performance. Despite the division, each area of testing cross-pollinates each other to facilitate both proper functioning and end delivery. Some key areas of testing that encompass both functional and nonfunctional and are ripe for automation include:

Application Testing

Insurance application testing assesses the full insurance domain: underwriting, policy admin, billing, claims, etc. Insurance application testing lies at the center of functional and nonfunctional testing, aiming for the smooth operation of business functionalities to deliver accurate and reliable access for customers. It validates the rules of filing a claim, test scenarios for customer risk and policy termination, underwriting quality, and more. These are critical processes that are subject to constant modification. Automated continuous testing ensures that the application runs correctly even as changes are made to coverage, policy workflow, and claims processing throughout the entire product cycle.

API Testing

APIs enable data exchange to facilitate communication across various software systems. API testing goes hand-in-hand with application testing; it tests the functionality, performance, security, and reliability of the programming interface and also identifies any bug or vulnerability affecting its responsiveness. Many insurers still rely on manual API testing, utilizing a limited mixture of homegrown automation scripts and outsourced testers. Because APIs require constant feedback as part of both testing and deployment, automation maximizes on scalability. This allows insurers to expand the scope and breadth of testing, reduce technical debt, and identify defects at an earlier stage of the product cycle.

Performance testing

How quickly APIs can respond and communicate data dictates performance. Performance testing is fundamentally about customer experience, ensuring speed and stability while a user interacts with the application. It aims to improve load capacity while also identifying any defects prior to the application’s release. For insurers, this means ensuring efficient responsiveness from claim processing, intimation, and the overall user interface (UI). In the past, performance testing was often considered a last step in a waterfall framework. Now, performance testing can be automated at each step of the product cycle, simulating real-life users, validating checkpoints, and removing bottlenecks.

Security testing

Security testing aims to both protect customer and internal data. Simultaneously, it reinforces data integrity, confidentiality, authentication, and authorization. The big growth in data infrastructure/management and Cloud have also fostered more vulnerabilities, sophisticated cyberattacks, and data breaches. Security testing involves even more manual presence at times than performance testing due to its legal and ethical sensitivities. The amount of labor necessary pushes many insurers to place security and compliance as an additional step at the end of a product cycle. Automated security testing solves this issue by using consistent adaptable scripts to accommodate evolving regulatory requirements and protocols at every step of the product cycle.

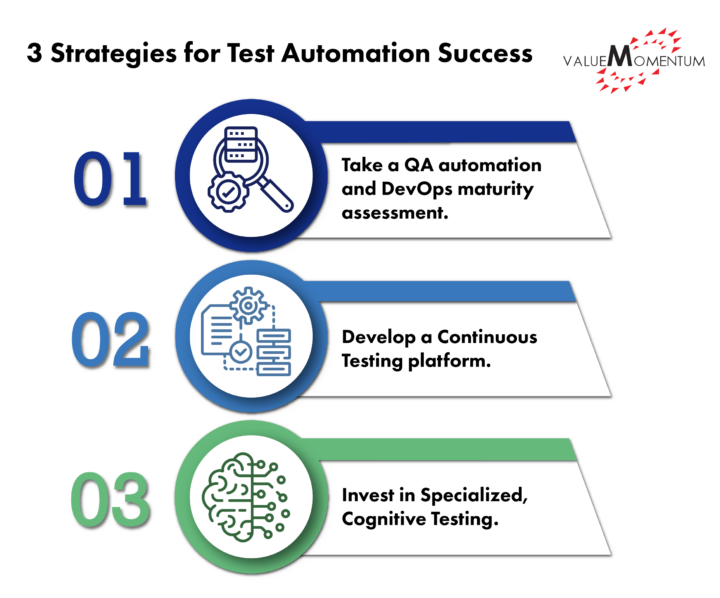

3 Strategies for Test Automation Success

The technical and business benefits of test automation are clear—reduced technical debt, faster defect/bug identification, reduced overall testing costs, and more. A sound QA/QE strategy will fully incorporate test automation as a key tactic to drive quality. Now, what can insurers do to initiate their QA/QE strategy? What priorities and tasks can they start tackling to fully utilize test automation?

- Take a QA automation and DevOps maturity assessment. While the long-term benefits of test automation are clear, its inclusion into a product cycle relies on a company’s readiness in terms of both technology and people. Automation strategies are not one-fits-all. An assessment can help an insurer understand what kind of re-skilling is needed in their particular QA workforce, as well as identifying at which stage of Agile/DevOps they are in. Depending on a company’s digital maturity, an incremental quality engineering plan may be more beneficial than an overhaul.

- Develop a Continuous Testing platform. A continuous testing platform goes hand-in-hand with DevOps/Agile methodologies. The entire organization has access to automation tools and its insights from one central platform, facilitating cross-team efforts at each step of the testing cycle. A continuous testing platform may also involve expanded Cloud-based solutions. A scalable, self-managing test platform on Cloud ensures more efficient test management that seamlessly integrates into an insurer’s CI/CD toolchain.

- Invest in Specialized, Cognitive Testin AI-based automation and analytics are expected to grow in both demand and capacity. AI use cases, model testing, virtual assistant testing, and RPA testing—as features of cognitive testing—promise even greater operational efficiencies that reduce manual labor while accelerating speed-to-market. However, many AI projects remain fragmented and short-term. Forward-looking insurers will benefit from investing more in cognitive testing, preparing their own readiness to utilize those tools in more long-term QA and QE strategies.

Test Automation: The Core of Continuous Testing

Test automation—centered on the principles of Agile and continuous testing— allows an organization to ensure quality and react to market opportunities with speed. Using test automation does not mean replacing all manual labor; it ultimately promises a smart hybrid of AI and human work force, automating repeatable testing and functionalities while allowing teams to develop new features to further evolve customer experience and drive ROIs.

Is your firm prepared to embrace QA automation into your Quality Assurance and Engineering strategy? Learn how you can get started by visiting our Quality Engineering page.