Underwriting environments and the process of risk evaluation are becoming more complex. As the insurance industry goes through a technological shift, there is a need for innovative thinking to update and improve the underwriting process. Taking a more strategic approach to underwriting will help insurers better calculate risk and provide faster and more accurate quotes.

Part of this underwriting transformation requires analyzing claims data to identify what factors create risky or high-vulnerability scenarios, and monitoring those areas actively to understand the impact of the risk, considering environmental factors and new and evolving threats.

To help improve the underwriting of homeowner policies, ValueMomentum partnered with a Fortune 500 insurer to examine how AI can enhance the process of homeowner claims and property insurance. The project was led by a data science analyst from our DataLeverage team at ValueMomentum. In this brief overview, this team gives us insight on what they’ve learned.

Use Case: Building a Strategic Tool for Roof Damage Insurance Claim

In homeowner’s insurance, nearly 50% of homeowner claims are roof-related. Roof claims have the potential to be reduced significantly through regular inspections and updating the roof materials, fixing shingles, removing debris, and more.

Leveraging available data, our team wanted to develop a tool that would provide insight on which roofs were vulnerable to destruction, helping underwriters provide more accurate quotes for their customers. Additionally, the insurer wanted to provide risk classifications of the roofs that would allow them to make recommendations to the customer, or initiate roof inspections and proactively fix the roof—thereby increasing customer satisfaction and decreasing roof claims.

Our team’s project predicts if any given roof is in good, fair, or bad condition based on aerial imagery. Take a look at this image —

— some roofs are green, which tells us it’s in good condition, and red tells us it’s in bad condition.

Key Technology: Using AI Imagery to Enhance Underwriting

Our approach to understanding roof claims and predicting roof damage involved using AI to build machine learning models that give roofs a score. That score is used to enhance the underwriting of homeowner policies.

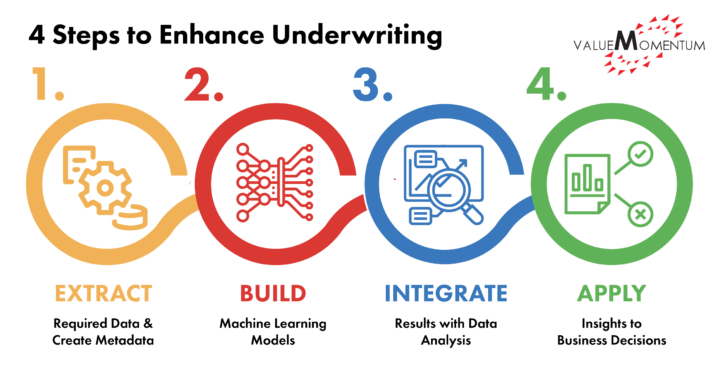

The approach that we took consisted of 4 main steps:

- Extract required data and create metadata. Our team ran a batch pipeline, generating end-to-end steps to extract data from our vendor partners. Those steps included geocoding, intake of property and parcel information, and obtaining satellite tile images. Using satellite imagery alongside this data, we created metadata and stored it on a cloud computing service.

- Build machine learning models. We then built machine learning models based on those satellite images. Our models then predict if a given roof is good or fair or bad. We stored the results of our best prediction.

- Integrate results with data analysis. The results are integrated into our product — an underwriting portal dashboard. The dashboard provides roof information, roof condition and gives the roof quality score metrics. The results leverage live data and the output of around ten prediction models that are aggregated and analyzed en masse. The predictions provide a dynamic evaluation of the roof.

- Apply insights to business decisions. Quality scoring of roofs in real time allows insurers to enhance their underwriting process. By doing this active monitoring, insurers also have the opportunity to improve customer experiences and demonstrate an investment in longevity and trust in their customer relationships by sharing valuable insights.

Project Value: Adopting New Technology for Future Strategic Underwriting

By using technological expertise, our data science team have generated a tool that uses advanced technology to improve the underwriting process. The generated tool using AI and aerial imagery works towards improving the underwriting process. To further improve the effectiveness of the tool, we are collaborating with our insurance partners. After the model makes a prediction, insurers go on the scene and make physical inspections, providing us with feedback on the accuracy of our predictions. This feedback is then used to retrain the models and improve the tool even further.

In implementing this tool—and leveraging AI and existing data—insurers are shifting towards the predictive mode, positioning themselves to play a significant role in early stages, not just in the aftermath of disasters.

Interested in using innovative technologies to improve your insurance functions? Explore our Data & Analytics services and see how we can help you transform your business.