Although only a small percentage of claims ever reach litigation, their financial impact is disproportionate. Ernst & Young reports that for P&C insurers, leakage tied to litigated claims can represent 7-14% of total carrier spend — a significant drag on profitability. And beyond the financial costs, litigated claims prolong settlement cycles, increase legal complexity, and frustrate policyholders.

For insurers, the real challenge isn’t managing litigation once it happens; it’s spotting the claims most likely to escalate early enough to intervene. Traditional approaches rely heavily on adjuster intuition or late-stage legal review, which means opportunities to prevent escalation are often missed.

This is where advanced analytics come in. An early litigation risk prediction system can flag high-risk claims as early as first notice of loss (FNOL), giving insurers the ability to act before costs spiral and customer trust is lost.

Rising Claims Litigation Costs and Complexity

Litigated claims create a ripple effect of challenges for insurers. Beyond the direct legal expenses, they extend settlement timelines, tie up capital, and strain adjuster bandwidth. Policyholders feel the impact as well, with longer wait times and more contentious claim experiences driving down satisfaction and loyalty.

Systemic pressures compound this rising complexity. Multi-party disputes, evolving fraud tactics, and stricter regulations make claims harder to manage. Plus, the costs themselves are escalating. Swiss Re Institute reports that litigation costs have driven US liability claims up 57% over the past decade, underscoring just how quickly expenses can mount when disputes enter the courtroom. Frequency is climbing as well: Insurance cases litigated in federal district courts jumped 30% in 2022 compared with the prior year.

The key to controlling litigation costs isn’t just managing cases once they escalate — it’s predicting which claims are likely to end in litigation at the earliest point possible. An early litigation risk prediction system applies analytics and artificial intelligence (AI) to flag high-risk claims right at FNOL, giving adjusters the intelligence they need to intervene before legal costs mount.

Turning Risk Prediction Into Measurable Results

Building and applying an early litigation risk prediction system isn’t just about generating better risk scores — it’s about driving measurable business results. By embedding advanced analytics into claims workflows, insurers can reduce litigation costs, accelerate resolution, and strengthen policyholder trust.

The outcomes span both operational efficiency and strategic advantage:

| Proactive Handling of High-Risk Claims | Early alerts ensure high-risk claims are flagged at FNOL and routed to adjusters or legal specialists with the expertise to intervene before disputes escalate, reducing both costs and reputational risk. |

| Reduced Legal and Operational Expenses | Lowering litigation frequency and severity directly cuts costs and leakage. In fact, insurers leveraging AI-powered analytics to manage litigation achieved up to a 15% reduction in legal spend by reallocating cases more effectively. |

| Faster, Fairer Settlements | Claims flagged early can be addressed with proactive negotiation and specialized resources before disputes intensify. This shortens cycle times, minimizes legal entanglements, frees up reserves sooner, and boosts policyholder satisfaction. |

| Smarter Use of Resources | Embedding risk scores into adjuster workflows helps carriers allocate the right level of expertise to the right claims at the right time. Senior adjusters and legal teams can focus on high-risk files while low-risk claims can flow through without unnecessary friction. |

| Portfolio-Level Insights | Portfolio-level intelligence shifts litigation management to a proactive, data-driven business strategy. Patterns can reveal systemic issues, like specific jurisdictions, injury types, or claimant behaviors, to improve reserving, pricing, and defense strategies. |

Together, these outcomes highlight how predictive litigation analytics create tangible financial gains, streamline operations, and improve customer trust.

Early Litigation Risk Prediction

Without proactively working to transform claims, insurers remain stuck in a reactive posture, intervening only after costs have already spiraled. Insurers who invest in early risk prediction can significantly reduce litigation expenses, improve loss ratios, and position themselves as customer-centric leaders in a competitive market.

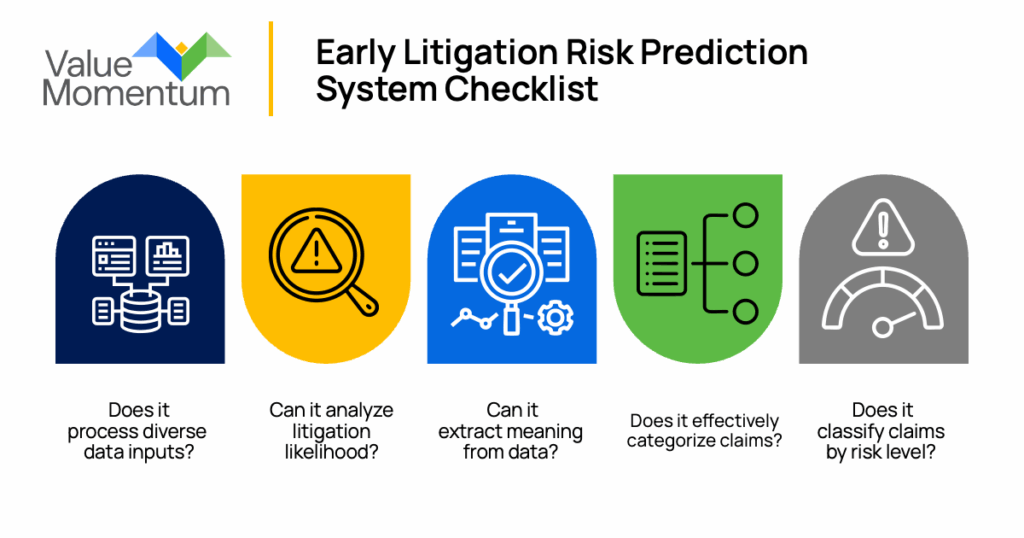

Here is a checklist to ensure that an insurer’s early litigation risk prediction system is ready to help the organization stay ahead of escalating litigation costs:

- Does it process diverse data inputs?

An effective prediction system must be able to ingest both structured data — such as policyholder profiles, claim history, attorney involvement, injury type, geography, and complexity — and unstructured insights from adjuster notes, call transcripts, claimant narratives, and other interactions. - Can it analyze litigation likelihood?

Using litigation propensity modeling, effective systems can predict the likelihood of litigation at FNOL using historical claim patterns.

It evaluates structural drivers such as injury type, coverage complexity, claimant behavior, and attorney involvement trends to surface early risks. Advanced models also incorporate time-based signals, continuously updating the score as new events occur throughout the claim life cycle. These models go beyond simple prediction by identifying key triggers that historically led to disputes. The output allows carriers to intervene earlier, reducing legal cost exposure and improving customer outcomes. - Can it extract meaning from data?

Processing data isn’t enough; successful analytics systems must be able to understand the information within the data. With natural language processing (NLP) in place, these systems can read and provide insights into adjuster notes, transcripts, and free-form text to capture sentiment and intent. - Does it effectively categorize claims?

Effective claim categorization groups claims based on complexity, severity, financial exposure, and behavioral patterns learned from historical data. The system identifies which claims are straightforward and which require deeper investigation, enabling precise workflow routing. NLP-driven insights further classify claims by sentiment, dispute types, and claimant intent captured from notes and transcripts. This segmentation ensures high-risk or high-severity matters reach senior handlers early, while low-complexity cases move quickly through automated pathways. - Does it classify claims by risk level?

When these other conditions are met, an early litigation risk prediction system should be able to produce a litigation risk index (LRI). This scoring mechanism classifies claims into categories based on risk that determine what action is taken next:

- High Risk: Escalate to legal or senior adjusters.

- Moderate Risk: Monitor closely with targeted flags.

- Low Risk: Proceed through the standard workflow.

By uniting structured data, human expertise, and advanced modeling, insurers gain a 360-degree view of litigation risk. Instead of relying solely on adjuster judgment or late-stage red flags, the system provides actionable intelligence early — ensuring resources are focused where they matter most.

From Reactive Defense to Proactive Prevention

Litigation will always be a reality in insurance, but it doesn’t have to be a runaway cost driver. By predicting which claims are most likely to escalate, insurers can shift from reacting to disputes after they arise to preventing them at the earliest stages.

Early litigation risk prediction enables faster settlements, lower legal spend, and stronger policyholder trust — all while equipping adjusters with the intelligence they need to act decisively.

Want to see how AI can unlock even more claims transformation opportunities? Watch our webinar, “AI Insider Insights: AI Claims Use Cases.”