Insurers today are applying innovative technology—such as AI and ML—to enhance all parts of the insurance value chain. No longer impressed by the newest, shiniest tool — insurers are now more focused on where their investment in tools and technology can yield the most value. This is especially true when it comes to applying technology innovation to their core foundation since modernizing their core requires a major upheaval of existing systems that may take a long time and high costs to implement.

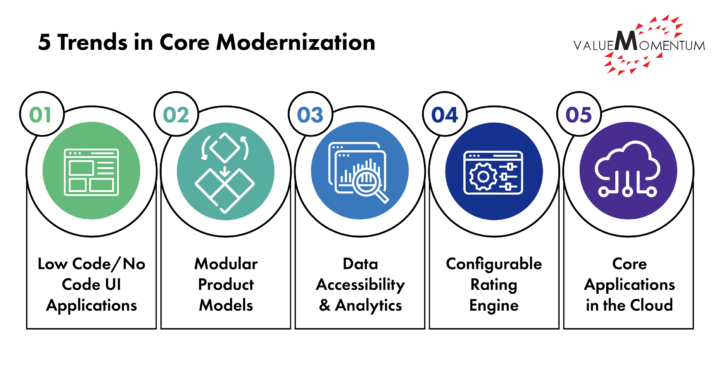

As insurers of all sizes seek to drive growth through expanding into new markets, rolling out new products, expanding into new distribution channels, and optimizing business processes to improve customer experience, core modernization will be critical to deliver on these business outcomes. Across the industry, several core initiatives are becoming common for carriers looking to remain competitive and grow revenue; this includes projects to add new multi-channel for self-service; develop highly customized and UI-focused capabilities; and improve familiar business functions like rating and product development. For core modernization, here are 5 industry trends, which provide insight into which capabilities and solutions are defining the new landscape of core insurance systems.

5 TRENDS IN CORE MODERNIZATION

- Integration of Low code/no code UI applications for a better digital experience

By integrating low-code/no-code platforms, insurers have been able to speed up the design and deployment of digital front-end experiences and UI-focused applications such as portals or workflows. Low-code/no-code platforms allow for users to easily and often visually create applications, making them more intuitive and agile. Often this is done by leveraging automation to modernize and streamline existing processes. Due to their desire for configuration and customization, insurers are moving away from purchasing single-point solutions from vendors and looking for quick ways to build custom applications for customer-facing mobile apps, agent portals, policy administration and more. Many insurers are finding low-code/no-code platforms as tools to significantly reduce costs of development and increase core capabilities.

- Investment in Modular Product Models to accelerate product development

Core capabilities for efficient product development are also becoming more widespread, as more insurers look for ways to quickly implement product changes and roll out new products. Component-based product designing tools are becoming more common, wherein insurers can leverage pre-built product definitions or base product designs, or reuse product code to develop new products. Instead of building products from scratch or taking years to research and develop a product, insurers can develop a single product version then modify and customize it to their requirements.This approach allows insurers to develop their MVP by quickly testing multiple versions of a product, and create highly tailored products for customer segmentation. This easy-to-use process for product design allows insurers to focus their efforts on leveraging advanced analytics and ideating products for emerging or hard-to-insure risks—critical capabilities for insurers looking to expand into new lines of business, new geographical regions and markets, or commercial and specialty lines.

- Increasing data accessibility and analytics for business users

Many insurers are integrating modern data platforms and infrastructure into their core systems to be able to access data and business insights more easily. Instead of relying on IT services and manual efforts, insurers want to democratize data insights and automatically ensure that all the data they’re collecting is vetted, of high quality, and secured. While many insurers have already incorporated data repositories such as data lakes, they are now turning to data tools to democratize reporting and self-service analytics – such as leveraging Power BI for underwriting – and utilizing AI reading tools to organize unstructured data and documents.By enabling their non-tech-savvy employees to ingest a higher volume, variety and velocity of data, insurers can drive operational efficiencies and empower data-driven decision-making at all levels.

- Configurable Rating Engine for faster pricing of risk

Instead of relying on excel and spreadsheet ingestion, insurers are investing in configurable rating engines as part of their core systems. These modern quick-quote engines allow business analysts to automatically price risk based on predefined rules, pricing models and rate tables. The rating engines on the market today can be configured by business analysts, without the need for IT or developers’ manual labor.Specialty and commercial lines are also investing in configurable engines as integrations that can accommodate unique rules for more complex or niche claims. By deploying these engines, insurers can generate quotes with accuracy, agility, and speed.

- Migrating core applications to the cloud is becoming the new normal

Almost all insurers have at least some infrastructure on the cloud, and most are planning to migrate core applications to the cloud. Insurers are now embracing a “cloud-first” strategy, acknowledging the benefits that come with cloud computing for all operations and business processes: faster upgrades, better maintenance and scalability, flexibility, quicker deployment, and cost-effectiveness.Many providers with insurer clients using on-premises products have established initiatives to help insurers migrate their applications to public cloud and cloud-native application hosting. Overall, cloud products are going from “cutting-edge” to “the new normal.” Current providers are encouraging insurers to fully abandon on-premises, and newer providers are only offering cloud services. Insurers can expect growth in accessibility to cloud-native computing in the future.

Modernizing core systems to maximize business value

These trends show that insurers are investing in their core modernization initiatives to prepare for an insurance future that is multi-channel, has risk-specific segmented markets, and is user-friendly and data-driven.

In evaluating your insurance company against these trends, keep in mind that there is an increase in full-suite modern solutions that include many of these capabilities with ecosystems in mind. If your organization is looking to implement a modern core system, it’s important to heavily strategize to ensure your investments won’t lead to overly complicated core systems in the future—ones you will need to modernize once again to support your business growth.

As insurers make changes to their core, they should also factor in new insurance distribution models to drive growth. When working with a mix of distributors — digital agents, wholesalers, MGAs, direct, embedded and more —, insurers have to make sure all core components can integrate with API platforms and delivery capabilities.

Curious about which core capabilities will bring the most value to your business strategy? Visit our Core Leverage Services to learn how ValueMomentum can help you modernize your core to support your future growth.