For years, insurers have relied on traditional analytics to measure outcomes and assess performance. But the landscape is evolving rapidly. Advanced analytics capabilities — powered by artificial intelligence (AI), machine learning, and big data processing — are helping insurers elevate their data-driven decision-making. These tools enable insurers to analyze vast volumes of real-time structured and unstructured data, gain deeper insights, and make highly accurate predictions at every point in the claims life cycle.

This shift is particularly impactful in claims management, an area notorious for high volumes of complex, variable data that traditional methods often struggle to manage. Advanced analytics can optimize critical touchpoints like claims segmentation, knowledge management, fraud detection, and litigation propensity, helping insurers enhance operational efficiency, improve recovery rates, and deliver superior customer experiences.

Questions to Prepare for Advanced Analytics

However, maximizing the value of advanced analytics requires a strategic, deliberate approach. To fully realize the potential of these capabilities, insurers must answer seven critical questions:

1. What is the insurer’s current AI and analytics strategy, and how does it align with business objectives?

Every insurer needs a well-defined strategy for incorporating AI and analytics into claims operations. While analytics can significantly improve areas like fraud detection, loss-cost containment, and customer satisfaction, alignment with strategic business goals is critical.

For example, a leading mid-market P&C insurer ValueMomentum worked with wanted to reduce missed opportunities, make the adjuster process more efficient, and improve its loss ratio. To achieve this goal, it deployed a subrogation prediction model at first notice of loss (FNOL) that integrated directly with the insurer’s claims platform. Within 12 months, the claims team identified 12% more recovery opportunities and automated a quarter of its referrals, contributing to an improvement in overall loss ratio. Without this strategic alignment, analytics initiatives risk becoming isolated tech experiments rather than drivers of enterprise value.

2. What is the current level of penetration of analytics across the claims organization?

Analytics maturity varies widely across insurers. Some still rely on basic descriptive reports, while others have embedded predictive and prescriptive analytics into daily operations. But just 49% of insurers currently incorporate AI into their claims processes.

Assessing the depth of analytics integration helps organizations identify gaps and prioritize their next investments. To extract maximum value, insurers must embed analytics end to end, from FNOL through settlement and subrogation. Insurers that apply predictive models during triage can proactively route catastrophic claims to specialists, speeding up settlements.

3. How effectively does the organization use data and analytics for day-to-day decision-making?

Effective application of data — not just its availability — differentiates industry leaders. According to McKinsey, insurers adopting real-time, data-driven decision-making achieved a 15-25% increase in profits. To ensure these business benefits, organizations should regularly assess how well front-line claims teams are empowered with actionable analytics insights during daily operations.

For instance, Deloitte recently noted that real-time analytics could help P&C insurers cut down on claims fraud and save $80B-$160B by 2032. With an annual loss of $122B due to claims fraud, improving claims fraud decisions by integrating advanced analytics and modern AI tools could have an immediate impact on an insurance organization’s claims leakage and reduce costs by 20-40%.

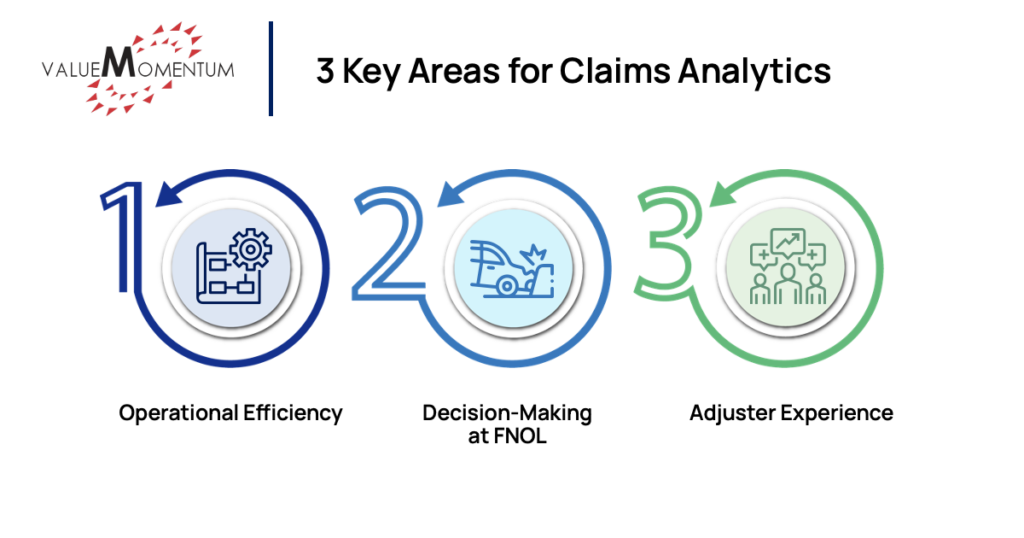

4. What should the primary focus areas for claims analytics be?

There are three key areas where advanced analytics can yield major results:

- Operational efficiency: Accurate measurement of expense and loss metrics can help claims organizations keep tabs on detailed pieces of data such as their loss ratio by line of business, expense by headcount, subrogation recovery rate, attorney performance, and more. In addition, process metrics like cycle time, number of reassignments, and path optimization can help improve the processes powering the entire claims organization.

- Decision-making at FNOL: Insurers can improve unstructured data processing by detecting claim severity from call transcripts, extracting claim characteristics, and using AI image recognition to determine severity. Claims analytics can improve assessment, too, by looking into factors such as FNOL outlier detection, litigation propensity, subrogation opportunity, and loss estimation.

- Adjuster experience: Claims segmentation based on complexity and automated assignment can help adjusters work more effectively. Similarly, access to intelligence like personalized claims metrics, on-demand access to similar past claims, policy coverage determination, and attorney selection can drive better outcomes.

When leveraged effectively, claims analytics can help insurers increase their gross written premium, retention rate, and customer satisfaction levels while driving down claims processing times and expense ratios.

5. What gaps exist in the organization’s ability to leverage analytics, such as talent, data quality, or technology infrastructure?

Even sophisticated insurers often face limitations, such as a shortage of skilled data scientists, siloed data, poor-quality or inconsistent data, and legacy core systems hindering real-time data access. Understanding and prioritizing gap closures — whether through hiring, technology upgrades, or data governance initiatives — is vital for future readiness.

For instance, Verisk found in a 2024 survey that nearly 60% of insurers plan to invest more in anti-fraud technology, such as claims analytics, to drive down their claims leakage and improve their loss ratios. There are other areas where investments in better initial data can help insurers yield better downstream results. Structured and enriched intake at FNOL, for example, can drive double-digit improvements in customer satisfaction with the claims process.

6. How are existing analytics teams structured?

Analytics organizational design plays a crucial role in an insurer’s ability to scale. Leading insurers often leverage a hybrid structure. Enterprise data teams manage infrastructure, governance, and core platforms while embedded analytics teams work directly with business units (like claims) to customize solutions.

Some insurers are establishing Data Science Centers of Excellence (CoEs) to ensure scalable model development, best practices in AI ethics, and operational standardization across lines of business. Allstate, for instance, was able to grow from three pilot models to 26 active projects in two monthsthanks to its Data, Discovery, and Decision Science (otherwise known as D3) analytics organization and its data science investments. Decentralized approaches to these typically take 18-24 months to achieve this kind of growth.

7. What are the adoption and scalability challenges for claims analytics?

When first adopting new claims analytics capabilities, insurers must ensure they are planning for integration with core systems, regulatory compliance, and the cost of deployment and maintenance. A phased rollout strategy using scalable frameworks that align with local and global regulatory standards can help balance costs and ensure compliance.

Middleware APIs and event-driven architecture can ease integration with core systems, while continuous monitoring to optimize performance will improve model efficiency over time. Feedback loops and end-user training are also critical for effective adoption of claims analytics.

Insurers also need to prioritize interpretable models or explainability layers to ensure transparency around the models being used. Modular, reusable components and configuration-driven logic can provide the flexibility needed to scale across products and regions. Being able to make decisions in real (or near-real) time requires low latency and high reliability; investing in a scalable, cloud-based infrastructure with load balancing can help achieve this.

Unlocking the Full Potential of Advanced Analytics in Claims

The journey toward analytics maturity is complex but highly rewarding. Insurers that proactively address these seven questions will be better positioned to unlock the true potential of their claims operations — delivering faster settlements, lower loss costs, higher customer loyalty, and stronger financial performance.

By aligning strategies, filling capability gaps, structuring teams smartly, and measuring value rigorously, insurers can turn advanced analytics from a competitive experiment into a sustainable engine of operational excellence and innovation.

Dive into more of the ways to leverage data and analytics across the insurance life cycle with our webinar, “Unlocking Opportunities – Data & Analytics in Insurance.”