The past decade saw widespread adoption of off-the-shelf, cloud-based insurance core systems as the industry looked to free itself from the limitations of legacy systems. These modern, on-premises solutions offered a way out of the costs and complexities of operating multiple parallel systems. In addition, they provided a clean, configurable, and seamlessly integrated platform that put speed at the heart of insurance operations.

But new demands for convenience, speed, mature ecosystems of services, and better digital experiences are redefining the capabilities required to succeed with today’s consumers. In addition, insurers and policyholders alike are navigating a world filled with emerging and shifting risks, from cyber-liability to climate change, necessitating new approaches to risk management and product development.

Recent catastrophes like Hurricane Helene and Hurricane Milton cost insurers billions of dollars. Rob Newbold, Verisk’s president of its Extreme Events Solutions team, estimates that Hurricane Helene cost anywhere from $6B-$11B and Hurricane Milton an astonishing $30B-$50B. While larger insurers may be able to help their policyholders recover from these types of disasters for now, smaller organizations are unlikely to be able to cover such high costs on their own.

Insurers have by and large embraced that they need to upgrade their core systems to deal with this new world (if they haven’t already moved to the cloud). However, moving to a modern system isn’t enough to succeed on its own. Insurance leaders must ensure that they are using their core systems to their fullest potential in order to navigate the future.

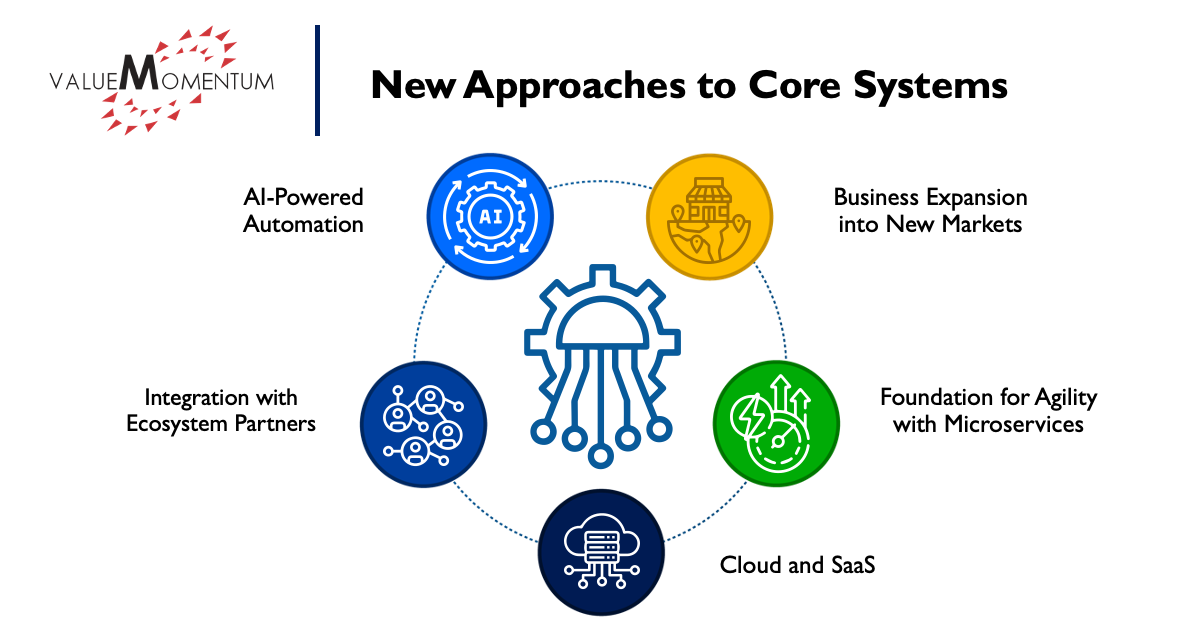

New Approaches to Core Systems

Insurers are faced with the challenge of making their investments count in new ways: greater flexibility and agility to scale, ability to incorporate leading-edge tools, ease of expanding into new segments and markets, and reduced operational costs.

Here are five major ways insurers are leveraging their modern core systems and how they are adapting their core capabilities to meet customer demands, face evolving risks, and compete in the digital era.

1. AI-powered automation

With the advantages of digitization, modern core systems are ripe for optimization and enhancement using AI, machine learning, and GenAI. Machine learning algorithms are capable of automating basic but time-consuming tasks, like form intake and entry using document capture technology, which is central to claims processing.

AI can add functionality like Tractable’s Auto Estimator, which provides real-time cost assessments based on a customer’s images of an accident. Less flashy iterations of AI, such as RPA, can simply streamline core operations, cutting costs, eliminating manual errors, and keeping teams’ attention focused on higher value tasks.

2. Business expansion into new markets or segments

Modern core systems are adept at adding new coverages and expanding existing products into new markets, segments, and states. Their support for configurable and reusable product development makes it easier to quickly deploy new policies to serve emerging needs, build new packages for changing customer profiles, or break them down to offer microinsurance options.

In a competitive digital landscape, expanding into new markets is becoming a necessity for many insurance carriers. For example, Pekin Insurance leveraged Guidewire Cloud to improve its ability to roll products out in new states. Leveraging the capabilities that come with modern core systems allows insurers to accelerate the development, testing, and rollout process, entering their target markets quickly to capture emerging opportunities.

3. Integration with ecosystem partners

Legacy systems are notoriously difficult to integrate with other applications, which has been a major driver of the transition to modern core systems. Unlike legacy systems, newer systems can be extended to incorporate third-party software and services via APIs. Leveraging core systems’ ability to integrate with partners’ data and services can help insurers provide the seamless digital experiences consumers have come to expect.

According to PwC, 81% of insurance professionals somewhat or strongly agree that insurers will continue to engage more in broader ecosystems that serve customers beyond insurance coverage. This may take the form of embedded insurance, cross-industry partnerships, or more as insurance carriers continue to evolve to stay competitive.

4. Foundation for agility with microservices

As opposed to treating modern core systems as monoliths, these platforms can be decoupled from a strictly end-to-end model to capture emerging opportunities. This means promoting a stronger focus on the organization’s core competencies and reducing the overhead needed to build and deploy new products or services. The move to microservices better enables insurers to stay nimble enough to connect to additional platforms like underwriting workbenches or pricing engines that meet their organization’s needs more effectively than out-of-the-box policy administration systems might.

Instead of owning several monolithic, complex, and static systems, insurers can lean toward running smaller, discrete cloud-enabled and API-connected services that can pair between partners and across industries, with the overall goal of emphasizing speed and flexibility. These are independent services that serve a specific business goal — like processing payments — and can be managed as a single business-technology unit, enabling fast, efficient decision-making that can quickly adapt and respond to opportunities for growth. Uber, the canonical example, is comprised of 4,500 microservices that can be switched out, modified, or exported to other businesses without affecting the rest of the system.

5. Cloud and SaaS

Cloud deployments are becoming the norm for modern core systems. A cloud-based core provides for automatic scalability, giving insurers the flexibility to experiment and act quickly on the results, without incurring major IT costs. Modern systems are also typically better equipped to integrate with leading-edge applications powered by tools such as GenAI and machine learning, which are becoming more widely applicable to every area of insurance.

Pekin Insurance, for instance, recently migrated its core systems from on-premises to Guidewire Cloud Platform to better facilitate its business growth goals. After the move to cloud, the insurer was able to expedite the rollout of five lines of business into a new state, achieving more than 50% of its annual growth goal in Q1 alone.

The Future of Insurance Core Systems

Now that most insurers have invested in digital software solutions, it’s time to stretch those capabilities into the future. Taking full advantage of modern core systems’ configurability enables carriers to enrich and automate business processes by integrating with third-party data and software, to enhance product development and avenues for deployment, and to seize new opportunities for expansion.

Moving from legacy systems to cloud deployments and SaaS solutions is helping carriers ensure reliability at scale and ensure they are part of the growing insurance ecosystem. Cultivating strong relationships with new customers, agents, and third-party partners is becoming the next frontier of competition for modern insurers.

To learn more about how modern core systems are helping insurers drive business growth, read our case study Usage-Based Insurer Improves Geographic Expansion on Duck Creek OnDemand.