Digital transformation is a must for any enterprise that aims to meet today’s customer demands for personalization, relevance, and connectivity. To maintain a competitive edge, businesses must leverage advanced digital technologies and harness the power of data that flows through their entire value chain. For a data-heavy industry like insurance, managing data and delivering real-time intelligence from data is essential to meet customer demands, capture new market opportunities, and drive growth. As all these functions depend on system connectivity, APIs have become key enablers of digital transformation.

How to Leverage APIs in Insurance

APIs create the bridge between customer expectations and the ability of businesses to deliver. APIs allow insurers to create connectivity and facilitate interactions among applications and devices by providing a standard way (protocol) to access data—whether on cloud or in-house—from any app or device.

Such API-led connectivity helps insurance firms turn repetitive tasks used for complex processes into highly reusable ones that drive productivity. The results are not just greater efficiency for insurers but better experiences for their customers who benefit from faster service enabled by streamlined underwriting and claims processes.

APIs can also help create better customer experiences and offer expansion possibilities into new market segments through integrations with partners and third parties. With the development of digital ecosystems and customers wanting more, APIs are key to attracting new customers and not just retaining but selling more to existing ones.

4 API Use Cases in Insurance

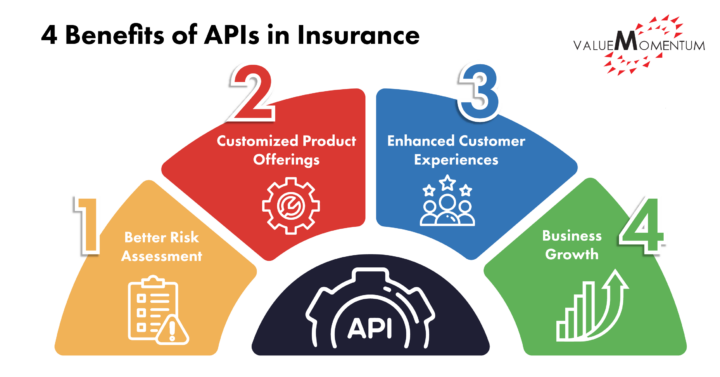

All forms of insurance – life, health, P&C, or business — can reduce costs and increase revenue by effectively harnessing the power of APIs. Everything from telematics to real-time risk assessment, user-based insurance (UBI), customized products, and better customer experiences depends on connecting the essential points of data with actionable insight through API connectivity. The main benefits of API in insurance can be found in four use cases.

- Better Risk Assessment

Through APIs, insurers can access larger pools of data which permits them to provide more intelligent risk evaluation, real-time fact-checking, and reduced underwriting times to their customers. That insight into risk factors is no longer limited to static data on the insured property or vehicle or the recorded vital statistics for an individual. Thanks to the internet of things (IoT) and telematics, insurers can be informed not just about the past but about what’s happening right now.On the property & casualty side, insurers are getting real-time risk data from devices to assess a driver’s risk profile. Property insurers have also begun applying real-time data to home protection. Taking in the data generated by the rise of smart homes and smart devices through APIs makes it possible for insurers to monitor conditions, pick up alerts on risk, and reduce their loss ratios. Smart sensors can also warn owners of leaks and other threats of floods or damage to commercial property.

On the life side, life and health insurers seek data insight to improve health factors. Drawing on data from wearables, insurers can take lifestyle factors of customers—like how active they are during the day—into account on top of the standard readings taken by an intake evaluation like weight and blood pressure. More information about the individual makes the assessment more accurate and allows for much more personalized offerings based on the risk factors.

- Customized Product Offerings

While insurance has always dealt in segmentation, the dynamic connections of APIs have the potential to offer a far greater degree of personalization. Insurers now have the capability to offer tailored, usage-based products to suit the individual needs of their customers.With all the data generated by devices, apps, and ecosystems, insurers can leverage tools such as artificial intelligence (AI) and machine learning to analyze, process and manage the data to deliver customized policy offerings and real-time quotations. APIs facilitate this process by transferring data quickly and securely within the ecosystem.

When a customer applies for auto insurance, for example, an API integration with the ecosystem can pull up the relevant customer data, then generate applicable insurance quotes, and finally deliver the quotes to the customer. It can also draw on the dynamic risk assessment to make tailored offerings to their customers to meet their needs. An example of this is pay-per-mile programs that are now offered by major insurers like Allstate and Nationwide.

- Enhanced Risk Evaluation

Today’s consumers don’t want to deal with filling out complicated forms or relying on snail mail to deliver paper checks when applying for coverage or filing a claim. APIs solve these pain points by enabling customer self-service through digital channels.API integrations are at the very heart of straight through processing (STP) driven by customer activation. They allow policyholders to submit photos or videos of the damage at the first notice of loss (FNOL) and get approval and funds for repairs on the spot.

APIs can even assist with car breakdowns or accidents. Drawing on GPS built into the car itself or the drivers smartphone, APIs can pinpoint the precise location of the car and dispatch services to help. By serving the customer better at the critical time when they need help, insurers increase customer experiences and therefore customer satisfaction which, in turn, increases retention.

- Business Growth

Embracing the partnerships enabled by APIs will reward forward-looking insurers with new opportunities. While some partnerships will strengthen the insurer’s core offerings, as in the case of auto and home, some can open doors to reach new customers in new ways.An insurer can embed a transactional API into the website, mobile platform, and other digital channels of its ecosystem partners. That make it possible for the insurer to provide insurance coverage to customers who never even came to the insurer’s site.

For example, Nationwide partnered with Toyota Insurance Management Solutions (TIMS) to launch TIMS BrightDrive, a branded insurance solution that makes it easy for Toyota purchasers to earn discounts for their proof of safe driving through telematics.

Other opportunities for partnerships to reach new customers include realtors directing their customers to the right form of insurance for their needs, whether they are buying or renting, and retailers partnering with insurance companies to offer policies on bigger purchases or electronic devices at checkout.

By tapping into a wider range of business resources—by partnering with third-party providers and integrating data with other players in the ecosystem—insurers can gain access to new revenue streams and disruptive business models, allowing them to drive future growth.

Looking Ahead

For insurers looking to enhance digital capabilities and optimize customer experiences, API integrations are a must. As the digital ecosystem further shapes up, the leading carriers of tomorrow will be the ones that leverage (open) APIs for insurance to partner or orchestrate in a larger network to deliver a full suite of best-in-class solutions and services.

Ready to start your own API integration journey? Check out the blog API Development: A Framework to Overcome the Integration Challenges for tips and best practices.

Learn more about how we can help you drive success to your digital transformation with APIs by visiting our Integration Services.